Hull Street Energy is a private equity firm, based in Bethesda, that specializes in deploying capital into the power sector as it decarbonizes.

Late last month the private equity firm announced that it closed on a $1.125 billion institutional fund. The full announcement can be seen below:

Hull Street Energy, LLC (“Hull Street Energy”), the Washington D.C. area-based energy transition investment firm, today announced the final closing of its second institutional fund, Hull Street Energy Partners II, L.P. (the “Fund”). The Fund, which targets investments in the North American power sector as the economy electrifies and decarbonizes, was oversubscribed and closed at its hard cap of $1.125 billion. Hull Street Energy received strong interest from a diverse and highly regarded group of institutional investors, including endowments, foundations, insurance companies, leading consultants, pension plans, funds of funds and family offices.

Hull Street Energy is composed of a long-standing investment team including Sarah Wright, Michael Booth, Mark Orman, Matthew Willis, Steve Morris, David Meeker, Kevin Telford, and Scott Hofmeister. The firm is differentiated by its deep understanding of local and regional physical electricity markets and grid operations, and its highly quantitative approach to evaluating and managing power sector assets and businesses.

Hull Street Energy targets undermanaged middle-market electricity businesses. Its first fund is fully deployed, having acquired an attractive portfolio of hydroelectric assets, thermal power plants, and solar projects throughout the U.S. In January of this year, the Fund made its inaugural capital commitment to SunGrid Solutions, a growing Battery Energy Solutions Service (BESS) company.

Eaton Partners served as global placement agent for the Fund and DLA Piper served as fund counsel.

For further information about Hull Street Energy, please see www.hullstreetenergy.com.

Recent Stories

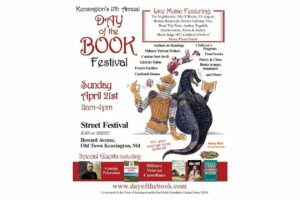

17th Annual Kensington Day of the Book Festival

Now in its 17th year, the Kensington Day of the Book Festival is a family-friendly street festival featuring 150+ renowned authors, poets, and literary organizations. Enjoy live music on five stages, special guest speakers, military veteran writers and comedians, poetry readings, cookbook demos, children's program, and much more.

Admission is free, and attendees will also be able to explore a marketplace of books and food offerings from local vendors.

Not your average book festival! This festival offers something for everyone!

17th Annual Kensington Day of the Book Festival

Sunday, April 21, 2024, 11am-4pm (held rain or shine!)

Howard Avenue, Kensington, MD 20895

www.dayofthebook.com

Instagram: @kensingtonbookfestival

Contact: Elisenda Sola-Sole, Festival Director

301-949-9416 (text preferred)

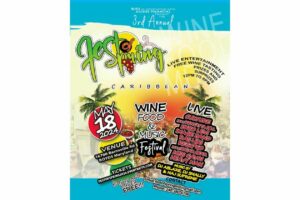

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!