COVID-19 Rent Relief Program

If you live in Montgomery County and have experienced lost income due to the #COVID19 pandemic, causing you to fall behind on your rent, the COVID-19 Rent Relief Program can provide short-term rental assistance if your household is eligible.

The COVID-19 Rent Relief Program provides short-term rental assistance to eligible households who have experienced lost income due to the COVID-19 pandemic that has caused them to fall behind on their rent. The program is managed by the County’s Department of Health and Human Services (DHHS) with funding from the Department of Treasury’s Emergency Rental Assistance Program.

While funds are available, the program will provide up to $12,000 to eligible households to pay for back rent owed and/or pay for up to three months of future rent. For households below 30% of the Area Median Income (AMI), additional financial help may be available. Funds awarded will take into account any other local, state, or federal assistance received to pay rent.

Frequently Asked Questions:

I am struggling to pay my rent, is there assistance available?

If you are behind on your rent because of a COVID-19 related loss, assistance may be available through the Department of Health and Human Services’ (DHHS) Housing Stabilization Services. Please complete the online application. If you are unable to complete the online application yourself or with assistance from your property/landlord, call 311 (240-777-0311) to request help. A County employee will call you back to help you complete your application.

Who is eligible for the COVID Rent Relief Phase 3 Program?

Households must meet the following minimum eligibility requirements:

- Have experienced a loss of income due to COVID-19

- Gross household income from previous 30 days at or below 50% of AMI

- Have been a Montgomery County resident since at least August 2020

- Owe at least $1,000 or more to current landlord

What is Area Median Income (AMI) and how do I know if my income is below 50% of AMI?

The Area Median Income is calculated by looking at the “middle” income of all households in the area. The table below lists the maximum annual or monthly gross income amounts.

| Family Size | Max. Annual Gross Household Income 50% AMI |

Max. Monthly Gross Household Income 50% AMI |

| 1 | $44,100 | $3,675 |

| 2 | $50,400 | $4,200 |

| 3 | $56,700 | $4,725 |

| 4 | $63,000 | $5,250 |

| 5 | $68,052 | $5,671 |

| 6 | $73,104 | $6,092 |

| 7 | $78,156 | $6,513 |

| 8 | $83,196 | $6,933 |

How do I apply?

You can apply online. You will be asked to answer questions about your COVID-19 related impact, household members, income, and rent. Please be prepared to upload supporting documents and have your landlord’s information available. Please note you will need an email address to complete the application. If you don’t have an email address, please consider setting one up or connecting with your property/landlord or anyone else that may be able to assist you.

I do not have access to the internet, and I am not able to receive assistance completing the application from my rental office. How do I apply?

If you do not have internet access or need other accommodations to complete the application, you may call MC 311 (240-777-0311) to request a County representative call you for assistance. MC311 will collect basic information from you and a program representative will call you back to help you complete the application.

What documents do I need to apply?

You will need the following documents to complete your application:

Photo Identification: Copy of a driver’s license, passport or other official photo ID for each adult member.

Verification of Residency/Address: You will be required to provide documentation that you live at the address you are applying for assistance for. You can do this with a bank statement, official piece of mail, utility bill or other documentation that confirms your address.

Income Verification: You will be required to provide documentation and/or self-certification that you have a gross household income that does not exceed the program limits. To verify income, applicants must provide documentation from either their 2020 tax return or from the previous 30 days. This can include:

- pay stubs

- interest statements

- unemployment compensation statements

IRS Form 1040 filed for the 2020 calendar year, or self-attestation/certification that clearly notes pre-COVID and current income

Rent Confirmation: You will need to provide documentation to show your rent responsibility, payment history and amount owed. This can be through rent ledger, lease, or other documentation that in combination provides the required information.

Landlord Documentation: Your landlord is requested to register with the County’s vendor registration system and provide documentation that confirms tenancy, rent information including amount of monthly rent and how much is owed.

I am on the waitlist and haven’t yet received assistance. How do I confirm that I am on the waitlist? And do I need to apply again?

Everyone that has completed the online waitlist form or called 311 to be placed on the waitlist will be contacted to complete a full application. If you provided an email address, you will be emailed the application link. If no email address was provided, a County employee will reach out to you to connect you with the application. A full application must be completed. You do not need to wait to hear from us to complete the full application. Your application will then be processed per the program guidelines.

Is there a deadline to submit my application?

No, there is no set deadline for application submissions; however, applications will be accepted until all program funds are fully expended. Funds are limited.

Is there a U.S. citizenship requirement? Do you require a Social Security number as part of an application?

Evidence of legal status is not required. The funding for this program is part of the Coronavirus stimulus bill passed by Congress; because it is emergency assistance, documentation of household legal status is not required. Similarly, social security numbers are not required.

What income needs to be reported and what do I need to include to show this?

Applicants must submit an accurate count of every member of their household and the income generated by all members of the household 18 and over that are not full-time students.

Income can be reported as either your household income on your 2020 tax return or your gross income from the previous 30 days. Gross Income should be reported prior to any deductions such as taxes and insurance. This includes but is not limited to: wages, social security, benefits/pensions, public assistance, unemployment, interest income, or child support. Please do not include Economic Impact Payments (Federal or State) or Federal Pandemic Unemployment Compensation (this is the extra $300-$600 provided with your unemployment benefits) when reporting your gross income.

What if I’ve had to move since August 2020? Am I still eligible?

As long as you still have a rent responsibility and have been a resident in Montgomery County since at least August 2020, even if you have moved within the County after that date.

I have an agreement with a friend to pay for some of the household expenses, but do not have my own lease, am I still eligible for assistance?

As long as you have an obligation to pay rent you are eligible for assistance, even if you have an informal lease. Whomever you have agreed to pay rent to will certify in writing how much you are expected to pay monthly and how much you have paid/owe.

I receive assistance to pay my rent from a housing subsidy program (housing choice voucher, rental assistance program, etc.), am I still eligible to apply?

Yes. You are still eligible to apply but assistance can only be provided on the portion of rent that is your responsibility. Additionally, we strongly encourage you to notify your subsidy provider of your change in income.

How much money am I able to get?

Eligible households may receive up to $12,000. Households with gross income below 30% AMI may be eligible for additional support. The funds are specific for rent and will take into account any previous funds received through COVID Rent Relief or other local, state or federal funds for COVID related rent support.

I already got assistance, but I am still behind on my rent. Can I get more help?

Yes. Even if you have already received COVID Rent Relief Program funds, you are eligible to apply again for additional funds, up to the program limit.

How will you process applications? Is it first-come, first-serve?

Applications will not be processed on first-come, first-serve, but instead will be processed based on a number of criteria, including location, employment status, and eviction status.

DHHS developed a Homeless Prevention Index to evaluate all neighborhoods in relation to COVID-19 impact, housing stress, and social determinants. This index will be used to prioritize assignment of applications for processing. You can view the map of priority areas at bit.ly/mc-hpi-map.

Additionally, households who have a member that has been unemployed for the previous 90 days or households with current eviction notices or judgements from the District Court will be prioritized.

These prioritizations will enable to the program to ensure that an equity lens is utilized, recognizing that communities of color have been significantly impacted by COVID, disproportionately experience homelessness, and are more likely to get evicted.

What if I do not live in one of the targeted “high impact” neighborhoods?

Phase 3 of the COVID Rent Relief Program will prioritize households renting in “high impact” neighborhoods. Households that are eligible, but do not live in the targeted “high impact” neighborhoods will be contacted as program capacity allows.

Will I receive the money directly?

In most cases, the grant goes directly to the property owner/landlord as a credit against your rent bill. If we are unable to coordinate with your landlord, the payment may be issued to you directly.

I do not have a letter from an employer, I am self-employed, or I do not have regular work hours. What do I do to verify my income?

You will be able to upload a self-certification in the application portal. This should include your employment/income information before COVID-19 and your current employment/income information.

I already received funding from the first phase of the DHHS COVID Rent Relief Program or another rental assistance program earlier this year. Can I apply again for more funds?

If you have already received assistance through the DHHS COVID-19 Rent Relief Program, the State Assisted Housing Relief Program, Housing Opportunites Commission’s COVID Rental Assistance Program or any other program to provide rental assistance, you ARE eligible to receive COVID-19 Rent Relief Funds.

Will I have to report this money on my 2021 taxes?

No, in most cases the grant goes directly to the property owner as a credit against your rent bill. Landlords do need to report as rental income as a rental payment.

Will accepting this assistance be counted as public charge?

DHHS is not a legal authority on public charge. We will recommend you contact the following legal resources if you have a concern.

- National Low Income Housing Coalition – FAQs

- Protecting Immigrant Families

- Gilchrist Center

- Maryland Health Connection

- One Nation AAPI-Asian American and Pacific Islander (frequently asked questions in Spanish and multiple Asian languages)

- Justice in Aging

I was able to pay my rent up until now, but do not think I will be able to pay next month, can I get help?

Unfortunately, this program is only available to households that owe at least $1,000 on their rent. If you find yourself in that position, please apply at that point.

Will I have to pay this money back?

No, this is not a loan. You will not have to pay the County back.

My landlord says I need to leave immediately if I cannot pay everything in full. Where am I supposed to go?

Only a sheriff, with a court order, can evict you. Please reach out to Landlord and Tenant Affairs at 240-777-0311 and the Police Department non-emergency line at 301-279-8000. Additional information is available on the Department of Housing and Community Affairs (DHCA) COVID-19 website.

I have a Court summons for an eviction hearing, what should I do?

We encourage you to participate in the court proceedings as you may be eligible for a COVID related delay in eviction. Please review the information available on the DHCA COVID-19 website.

I am a landlord and I think my resident may be eligible, what can I do?

Please complete the landlord portion of the application and support your tenant in completing their part of the application.

What documents does the landlord need to submit?

All landlords should register in the County’s Central Vendor Registration System to receive a payment from the County. You will also be required to provide documentation that shows how much your tenant pays monthly, how much they have paid and how much they owe. You must also disclose any other assistance being received for that unit.

Are there any requirements on the landlord to receive this assistance?

Landlords must agree to the following conditions:

- Forgive late fees, penalties, interest and legal fees;

- Cancel any current eviction actions and not sue to evict while receiving COVID Rent Relief Program funds and for 30 days after relief period (this does not include breach of lease actions for safety);

- If lease has expired, offer a lease renewal for a 90 day period; and

- Notify DHHS and return any remaining funds if tenant moves out.

Recent Stories

According to the Montgomery County State’s Attorney’s Office, “in the Circuit Court for Montgomery County, MD, before the Honorable Margaret Schweitzer, a jury found defendant, Geofrey Gaitan, 31, of Silver…

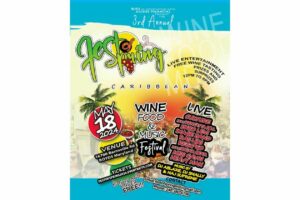

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!