Governor Hogan Announces $1 Billion Relief Act and Notes From January 11th Press Conference (paraphrased)

$1 billion relief act will provide a direct stimulus payment for low-to-moderate income residents– $750 for families, and $450 for individuals.

State and local income taxes on unemployment benefits will be repealed.

There will be a $300 million commitment to supporting small businesses with sales tax credits of up to $3,000 per month for four months, which can total up to $12,000.

The relief act will help more than 55,000 Maryland small businesses.

Per Hogan communications director Mike Ricci:

“This relief is automatic & based on a sliding scale up to $3,000. Examples: if you’re a business with $100,000 in monthly revenue and you collect $6,000 in sales taxes, you only remit $3,000. If you have $50,000 revenue and you collect $3,000 in sales taxes, you keep it all.”

Maryland businesses will be safeguarded against any tax increase triggered by the use of state loan or grant funds.

This will be introduced as emergency legislation so that relief measures can begin immediately.

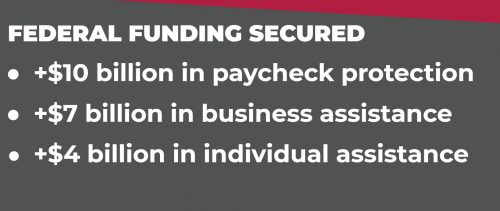

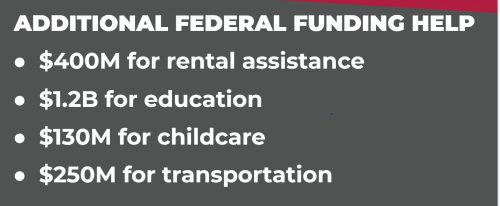

Graphics below, courtesy of Mike Ricci, shows federal and additional funding:

“Maryland’s economic performance went from 49th out of 50 states to one of the best in America.”

Question: Where is this money coming from?

Answer: Much of it is coming from budget actions taken earlier in the year at the board of public works. Reserve fund is doing better than anticipated. Small portion is coming from rainy day find.

Question: How’d you come up with $450-$750 payments

Answer: We don’t have the power to send $2,000 checks as it would drain the rainy day fund completely. This gets out more money to more people and gets it out faster.

Question: Can you describe the eligibility for these payments?

Answer: Marylanders who have qualified for earned income tax credit (lowest income Marylanders).

Question: Is this just for renters or also for mortgage?

Answer: This money is specifically for renters and not mortgages.

Recent Stories

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!