Per Montgomery County:

For Immediate Release: Friday, August 12, 2022

Montgomery County Executive Marc Elrich and County Council President Gabe Albornoz Friday announced Montgomery County has maintained its “Triple-A” bond rating for 2022 from the three major Wall Street bond rating agencies. The County continued its status as a top-rated issuer of municipal securities, with the highest credit rating possible for a local government. The rating is significant as the County continues to rebound from the impact of the COVID-19 health crisis. It is also worth noting that this was accomplished as the County met its longstanding fund balance reserve target of 10 percent.

Moody’s Investors Service, Inc., Standard & Poor’s, and Fitch Ratings all affirmed the Triple-A rating—the highest achievable—for the County. Montgomery County has earned Triple-A ratings from Moody’s Investors Service, Inc. every year since 1973 (50 consecutive years); from Standard & Poor’s every year since 1976 (47 consecutive years) and from Fitch every year since 1991 (32 consecutive years).

All three rating agencies emphasized Montgomery County’s large and diverse tax base, proximity to the District of Columbia, growing commercial and residential development as well as the County’s strong fiscal management policies and strong financial position.

- The Fitch Ratings report stated: “The ‘Triple-A’ Issuer Default Rating (IDR) and GO bond rating reflect the county’s stable economic underpinnings, superior gap-closing capacity, and low long-term liability burden. The ‘Triple-A’ rating is also supported by a demonstrated capacity to absorb revenue losses during periods of economic downturn and management’s ability to make sound fiscal decisions to restore and enhance the county’s financial cushion and operations during recovery periods.”

- The Moody’s reported stated: “ Montgomery County, Maryland’s (Triple-A stable) credit profile will continue to benefit from a dynamic and expanding economy, very affluent resident population, and a growing and highly educated work force. These strong economic and social factors, coupled with the County’s prudent financial management, have contributed to a long-term trend of growing revenues, surplus operations, and improving reserve levels.”

- The Standard & Poor’s report stated: “The County’s very strong property wealth and income levels, robust local job market, and access to the greater Washington, D.C. area for employment opportunities, in addition to well-established financial policies and practices, anchor Montgomery County’s credit quality. The County has leveraged its very strong economic underpinnings to support its sound financial position, as the County has historically maintained strong or very strong budgetary flexibility.”

The Triple-A bond rating enables Montgomery County to sell long-term bonds at the most favorable rates, saving County taxpayers millions of dollars over the life of the bonds. The rating also serves as a benchmark for numerous other financial transactions, ensuring the lowest possible costs in those areas as well.

“Wall Street’s watchdogs have once again found our local economy and County management practices as amongst a handful of the very best in the country,” said County Executive Elrich. “Out of more than 3,000 counties in this nation, Montgomery County is one of approximately 50 with a Triple-A bond rating from all three credit agencies. This mark of financial stability for more than three decades is a testament to consistent excellent financial stewardship, smart choices, and strategic investments. This bond rating saves our taxpayers millions of dollars in lower interest rates and demonstrates to the financial community that purchasing Montgomery County bonds is a wise investment. These funds are needed to continue to strengthen our County’s economy, create jobs and expand opportunities for our residents.”

“Montgomery County’s steadfast commitment to maintaining its fiscal principles during challenging times and our ongoing responsible fiscal management has enabled our community to maintain its coveted Triple-A bond rating again this year,” said Council President Albornoz. “The Council relied on long-standing and new fiscal policies that were necessary to maintain robust reserves, even as we continue to recover from the global pandemic. Despite the many challenges caused by COVID-19, Montgomery County has continued the longest string of Triple-A bond ratings of any county in the nation. This would not have been possible without the long-term fiscal planning done by the Montgomery County Council, especially Government Operations and Fiscal Policy (GO) Committee Chair Nancy Navarro and the entire GO Committee. We also recognize and thank County Executive Elrich and his fiscal team for their ongoing work and collaboration on this critical issue and the three bond rating agencies for their work.”

Councilmember Navarro, chair of the Council’s Government Operations and Fiscal Policy Committee stated: “I am ecstatic that once more Montgomery County has maintained its Triple-A bond rating. Montgomery County’s ongoing recovery efforts from COVID-19 have resulted in strains on our fiscal resources and government operations. It is our duty as legislators to act as good stewards of taxpayer money and to make decisions that fund needed services equitably and maintain fiscally responsible practices. This Council came together again this year to achieve these goals for our residents.”

# # #

Recent Stories

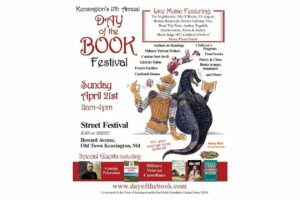

17th Annual Kensington Day of the Book Festival

Now in its 17th year, the Kensington Day of the Book Festival is a family-friendly street festival featuring 150+ renowned authors, poets, and literary organizations. Enjoy live music on five stages, special guest speakers, military veteran writers and comedians, poetry readings, cookbook demos, children's program, and much more.

Admission is free, and attendees will also be able to explore a marketplace of books and food offerings from local vendors.

Not your average book festival! This festival offers something for everyone!

17th Annual Kensington Day of the Book Festival

Sunday, April 21, 2024, 11am-4pm (held rain or shine!)

Howard Avenue, Kensington, MD 20895

www.dayofthebook.com

Instagram: @kensingtonbookfestival

Contact: Elisenda Sola-Sole, Festival Director

301-949-9416 (text preferred)

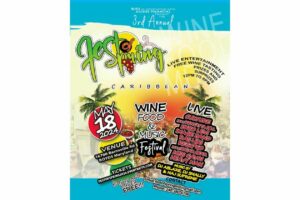

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!