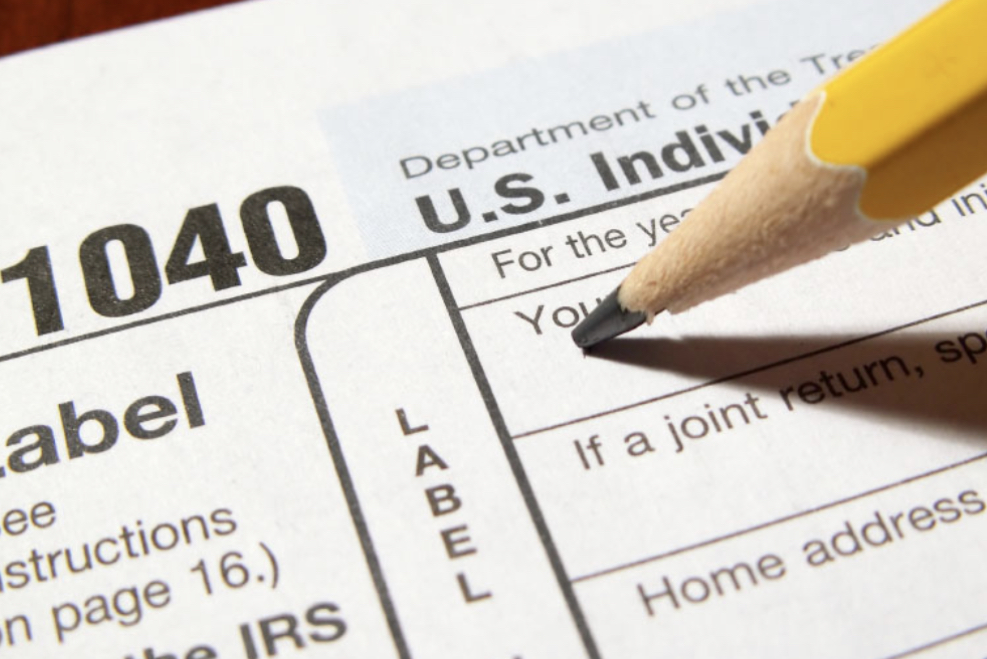

The annual Volunteer Income Tax Assistance (VITA) program, a partnership of the City of Gaithersburg & the Montgomery County Community Action Agency, is now accepting appointments to prepare 2022 taxes. Casey Community Center will host a VITA site on Mondays from 3 to 8 p.m. beginning on January 23, 2023.

The VITA program offers free tax preparation assistance to low- & moderate-income individuals who earn $60,000 or less per year. Preparation is done by IRS-trained volunteers who assist taxpayers in determining if they are eligible for the Earned Income Tax Credit & other tax credits. Services are offered in both English & Spanish. Appointments are available January 23 through April 14. Additional information below:

Appointments Only

Contact: 240-777-1123

Book an Appointment Online

Securely upload all required documents without leaving your home. Certified tax preparers are available to file your taxes for free. Now preparing 2022 federal & state returns.

Required Documents: The IRS will not allow VITA to prepare taxes without required documentation.

Be prepared to provide the following to your appointment:

- A Social Security card and/or ITIN for EACH family member. We cannot use prior year files to verify Social Security numbers.

- A photo ID for each filer.

- W-2 forms for all jobs worked in 2022.

- Child care provider name, address, and tax ID number or Social Security number.

- All banking account information (a voided check and/or savings deposit slip) to direct deposit your refund (or set up an account through our Bank On Gaithersburg program).

- A copy of last year’s tax return.

- Any document or information about money you have received from the IRS or state.

- All 1099 forms for other income, if any.

- Any other tax related documents you have received.

- If you are a victim of identity theft, you must bring the letter from the IRS with your PIN number. A new letter is issued from the IRS every year.

- If you purchased health insurance through the Marketplace for 2022, through Medicare/Medicaid, or through your employer, you should receive a Form 1095-A, B, and/or C. Please bring this form with you to complete your 2021 federal tax return.

- If you have a Marketplace Exemption, please contact the Marketplace and get your Marketplace Exemption Certificate number to complete your 2022 federal tax return.

- If you are married & filing jointly, your spouse must be present. If you are married & filing separately, you need your spouse’s name as spelled on his/her Social Security card & your spouse’s Social Security number.

Recent Stories

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!