From the Office of Council President Andrew Friedson: Bill would broaden eligibility for individuals 65 and older and retired military service members and their spouses

“Today Council President Friedson introduced new legislation with the goal of helping older residents and retired military service members and their spouses age in place in Montgomery County. Bill 45-23, Property Tax Credit – Individuals 65 and Above, Retired Military Service Members and Disabled Military Service Members, would expand and extend a county property tax credit, while implementing a progressive income scale for eligibility. Shortly after being unanimously elected Council President last week, Friedson announced that he wanted to focus the year ahead on unleashing the potential of Montgomery County’s fast-growing older adult population.

“As cost of living and property assessments continue to rise, many of our older adult residents need support to age in place with dignity and vitality,” said Council President Andrew Friedson. “This expanded property tax credit targeted towards long-time county residents who need it the most will help us fulfill our capabilities as a county of vital aging and a community for a lifetime.”

The bill would allow individuals to qualify for the credit if the assessed value of their home is $899,900 or less for the 2023 tax year, and this amount would be increased annually based on inflation. Currently, the maximum assessed value associated with the credit is $700,000 for individuals 65 and older and less than $550,000 for retired military members and their surviving spouses.

Additionally, the bill would increase the number of years an individual may qualify for the credit from seven to 10 years and reduce the amount of time an individual aged 65 or older must reside in their home to qualify for the credit from 40 to 25 years.

The new legislation also implements a progressive income scale for residents to quality for the property tax credit. Those with an annual income of $90,000 or less would receive a 20 percent property tax credit; residents with an income of $75,000 or less would receive a 35 percent credit, and those with an income of $50,000 or less would receive a 50 percent property tax break. Under current law, the amount of the credit is 20 percent of the County property tax imposed on the home.

More information on Bill 45-23 can be found here. The public hearing for this bill is tentatively scheduled for January 23, 2024.”

Recent Stories

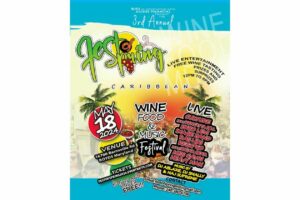

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you’re an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.