Senseonics Holdings, Inc. is a Germantown-based medical technology company focused on the development and manufacturing of glucose monitoring products designed to transform lives in the global diabetes community with differentiated, long-term implantable glucose management technology.

On Friday, the company announced FDA approval of the world’s first and only long-term implantable continuous glucose monitoring system. Per the release, “it now offers patients exceptional accuracy for 6 months.”

“We repeatedly hear from our patients with diabetes that what they desire is a long-lasting sensor that is also highly accurate,” said Satish Garg, M.D., Professor of Medicine and Director of the Adult Diabetes Program at the Barbara Davis Center of the University of Colorado, and the Principal Investigator of the PROMISE Study1, which formed the basis for the FDA approval. “The next generation Eversense E3 System delivers on both. Patients will appreciate the excellent accuracy of the system and the ability of the sensor to last 6 months. This is another step forward for patients who desire to manage their diabetes with all the advantages of the Eversense CGM with the fully implantable sensor.”

The full release can be seen below:

GERMANTOWN, Md.–(BUSINESS WIRE)–Senseonics Holdings, Inc. (NYSE American: SENS), a medical technology company focused on the development and manufacturing of long-term, implantable continuous glucose monitoring (CGM) systems for people with diabetes, today announced the approval of the next-generation Eversense® E3 CGM System by the Food and Drug Administration (FDA). The Eversense E3, including proprietary sacrificial boronic acid (SBA) technology to extend longevity to 6 months, is planned to be available to patients in the U.S. through Ascensia Diabetes Care, Senseonics’ global commercial partner, beginning in the second quarter of 2022.

“We repeatedly hear from our patients with diabetes that what they desire is a long-lasting sensor that is also highly accurate,” said Satish Garg, M.D., Professor of Medicine and Director of the Adult Diabetes Program at the Barbara Davis Center of the University of Colorado, and the Principal Investigator of the PROMISE Study1, which formed the basis for the FDA approval. “The next generation Eversense E3 System delivers on both. Patients will appreciate the excellent accuracy of the system and the ability of the sensor to last 6 months. This is another step forward for patients who desire to manage their diabetes with all the advantages of the Eversense CGM with the fully implantable sensor.”

The Eversense E3 CGM System offers patients:

- Fully implantable third generation sensor, with proprietary SBA technology to enhance sensor longevity, demonstrating a mean absolute relative difference (MARD) of 8.5% in the PROMISE Study.

- Industry leading 6 month sensor wear duration, making Eversense the longest lasting CGM system available, with essentially two sensor insertion and removal procedures per year.

- Removable smart transmitter, held in place with a mild silicone-based adhesive, providing discreet on-body vibratory alerts and data transmission to a mobile app where glucose values, trends, and alerts are displayed.

“Further extending the duration of the longest lasting CGM system to 6 months represents a massive leap forward for patients and towards our mission of transforming lives in the global diabetes community,” said Tim Goodnow, PhD, President and Chief Executive Officer of Senseonics. “The review was delayed by one year due to COVID-19 priorities and now together with our partner Ascensia, we can execute our launch plan to deliver the Eversense E3 CGM System to U.S. patients beginning in the second quarter. We look forward to initiating Eversense E3 sales and believe that, with Ascensia’s newly dedicated CGM commercial organization, the launch of the new 6-month product will establish the foundation for growth in our installed base later in 2022 and beyond.”

After the extended review during COVID-19, and with its next generation product now having been approved in the U.S., the Company concurrently is providing its 2022 financial outlook. The Company expects full year 2022 global net revenue to be in the range of $14.0 million to $18.0 million. The Company expects the majority of its expenses for 2022 to be for research and development for ongoing feasibility and pivotal clinical trials for additional products in its product pipeline, including the start of its 365-day pivotal trial, subject to IDE approval. Additionally, the Company currently expects to report unaudited revenues of approximately $4.0 million for the fourth quarter of 2021 and approximately $13.7 million for the full year ended December 31, 2021. The unaudited balance of cash, cash equivalents and marketable securities at December 31, 2021 was approximately $182 million. The Company expects to report its full fourth quarter and fiscal year 2021 financial results after the market close on Tuesday, March 1, 2022. The preliminary financial results described herein have not been audited and are subject to adjustment based on the Company’s completion of year-end financial close processes.

“The Eversense E3 CGM System is an exciting advancement in diabetes management,” said Francine Kaufman, M.D., Chief Medical Officer of Senseonics. “We believe patients and providers are waiting for this step forward. I want to take this opportunity to thank the PROMISE Study investigators, study participants, and the Senseonics team for helping us reach this important milestone, and the diligence of the FDA reviewers in this difficult environment. We are excited to begin making this next generation product available in the U.S. to people with diabetes.”

Patients who are interested in getting started on Eversense today can sign up at www.eversensediabetes.com/get-started-today, and will be among the first to know when Eversense E3 is commercially available. Physicians, nurse practitioners and physician assistants interested in offering the Eversense CGM System for their patients can sign up at https://www.ascensiadiabetes.com/eversense/become-a-provider/register/. Or contact 844-SENSE4U (844-736-7348) to learn more about the first and only long-term implantable CGM system.

About Eversense

The Eversense® E3 Continuous Glucose Monitoring (CGM) System is indicated for continually measuring glucose levels for up to 6 months in persons with diabetes age 18 and older. The system is indicated for use to replace fingerstick blood glucose (BG) measurements for diabetes treatment decisions. Fingerstick BG measurements are still required for calibration and when symptoms do not match CGM information or when taking medications of the tetracycline class. The sensor insertion and removal procedures are performed by a trained and certified health care provider. The Eversense CGM System is a prescription device; patients should talk to their health care provider to learn more. For important safety information, see https://www.ascensiadiabetes.com/eversense/safety-info/.

CRH Healthcare enters Montgomery County Maryland market in partnership with Adventist HealthCare by acquiring 3 Urgent Care centers

CRH Healthcare, an operator of urgent care centers in Alabama, Florida, Georgia, and Maryland has acquired Adventist HealthCare urgent care centers in Germantown, Rockville, and Laurel, the companies announced in a press release earlier this month.

Additional information is available in the full press release below:

GAITHERSBURG, Md. and ATLANTA, Feb. 1, 2022 /PRNewswire/ — CRH Healthcare (CRH), a quality- and patient-focused operator of urgent care centers in Alabama, Florida, Georgia, and Maryland has partnered with Adventist HealthCare (AHC) and acquired their three Urgent Care centers in Germantown, Rockville and Laurel, Maryland. All three centers have established themselves as leaders in their communities with experienced providers and support staff serving the walk-in urgent care needs of patients in the area as well as employers’ occupational healthcare needs. The centers will be operated by CRH under its Maryland brand, Patriot Urgent Care, and will be co-branded with “an Adventist HealthCare Partner”. The partnership begins Feb. 1, 2022 and will include having the centers join the One Health Quality Alliance, Adventists HealthCare’s clinically integrated network, which focuses on the coordination and quality of care across the healthcare continuum.

The current staff at each center will remain along with their dedication to serving the community, especially during the COVID-19 pandemic. These centers will join the other five Patriot Urgent Care centers in Maryland focusing on CRH’s Mission, “to deliver the Perfect Patient Experience every time.” It is this commitment to every patient that has helped drive the success of CRH’s growing network of over 70 centers since its founding in 2012. Bill Miller, CRH Healthcare’s CEO and co-founder, said, “We are excited to have the opportunity to work with Adventist HealthCare and their urgent care team in all three centers. Their success creates a great base of operations for CRH in Montgomery County and continues our growth throughout Maryland.”

Beyond these initial urgent care centers, CRH will continue to partner with AHC to better serve the Marylandcommunity with additional centers planned in the coming years. This partnership allows both AHC and CRH to provide better coordinated care for patients. Additionally, since all Patriot Urgent Care centers are open daily from 8 a.m. to 8 p.m., they provide a more cost-effective alternative to the emergency room for lower acuity diagnoses like the flu and colds, sprains, lacerations and other non-emergency care. The centers also support AHC’s primary care physicians with after hours and weekend coverage when patients need immediate after-hours medical attention. “One of our top priorities is improving access to quality care throughout our community,” said Terry Forde, president and CEO of Adventist HealthCare. “The partnership with CRH will be seamless for our patients and will continue our focus on providing care when and where the community needs it. We are delighted to have CRH Healthcare as a partner.”

About CRH Healthcare

CRH Healthcare (CRH), founded in 2012 and based in Atlanta, GA, is a consumer- and quality-focused urgent care center industry leader that has grown through both acquisitions and de novo (new) development. Everything the company does is focused on what it calls “The 5 C’s”—being Convenient, Caring, Courteous, Competent, and Compliant. Over the last eight years, the Company has rapidly grown its clinic base from 3 to 73 clinics and now has operations in Georgia, Florida, Maryland, and Alabama where they help patients Get in. Get out. Get Better!™ Typically the #1 or #2 player in each of its markets, CRH was recently named to the Atlanta Business Chronicle’s Pacesetter Award list for the sixth year in a row, which recognizes the fastest growing private companies in Atlanta. CRH Healthcare is a proud member of the Urgent Care Association. For more information visit CRHHealthcare.com or PatriotUC.com.

About Adventist HealthCare

Adventist HealthCare is one of the longest-serving health systems in the Washington D.C. region. Throughout its over 110-year history, Adventist HealthCare has remained true to its mission: to extend God’s care through the ministry of physical, mental and spiritual healing. As a comprehensive health system that includes three acute-care hospitals, rehabilitation, primary and specialty care, urgent care, mental health services, home care, and imaging services, Adventist HealthCare is committed to world-class care, every time to every patient. With more than 6,500 team members and over 50 locations, Adventist HealthCare’s nationally recognized services include maternity, heart care, joint replacement surgery, physical rehabilitation and cancer treatment. For more information about Adventist HealthCare, visit AdventistHealthCare.com/About

Amentum is a premier global technical and engineering services partner supporting critical programs of national significance across defense, security, intelligence, energy and environment. Headquartered in Germantown, Md., the company employs more than 37,000 people in all 50 states and performs work in 105 foreign countries and territories.

Earlier this week, the company announced the U.S. Air Force has awarded DynCorp International LLC, an Amentum subsidiary, a $147 million contract to provide maintenance and sustainment services in support of the U.S. Air Forces in Europe Global Prepositioned Materiel Services program. The contract consists of a base year and eight option years.

Las month, Amentum announced Charles A. Mathis as its new CFO- a position he held with SAIC from 2016 until he retired last year.

Additional information on the new contract can be found in the press release below:

GERMANTOWN, Md.–(BUSINESS WIRE)–The U.S. Air Force has awarded DynCorp International LLC, an Amentum subsidiary, a $147 million contract to provide maintenance and sustainment services in support of the U.S. Air Forces in Europe Global Prepositioned Materiel Services program. The contract consists of a base year and eight option years.

“We look forward to partnering again with our Air Force customer to provide maintenance services on various prepositioned assets in eight European countries,” said Joe Kelly, Senior Vice President of the Maintenance and Sustainment Sector in Amentum’s Mission Readiness Strategic Business Unit. “As the premier provider of maintenance services on prepositioned assets for the Department of Defense, we are proud to bring our unparalleled experience in supporting mission critical equipment for our military customers at sites worldwide.”

Amentum will provide a wide range of services, such as storage, maintenance, outload, reconstitution, exercise, and contingency logistics under this program to support the U.S. Air Force’s prepositioning theater requirements. This includes equipment such as Deployable Air Base Systems, Rapid Engineer Deployable Heavy Operational Repair Squadron Engineer (RED HORSE) sets, Emergency Medical Support Systems and Rapid Airfield Damage Repairs assets.

ABOUT AMENTUM

Amentum is a premier global technical and engineering services partner supporting critical programs of national significance across defense, security, intelligence, energy and environment. We draw from a century-old heritage of operational excellence, mission focus, and successful execution underpinned by a strong culture of safety and ethics. Headquartered in Germantown, Md., we employ more than 37,000 people in all 50 states and perform work in 105 foreign countries and territories. Visit us at amentum.com to explore how we deliver excellence for our customers’ most vital missions.

Bethesda’s Donohoe Hospitality Services is a leading hotel management company dedicated to excellence in service while providing outstanding performance for its owners and partners. Founded in 2005, Donohoe Hospitality Services is a division of Donohoe, an iconic real estate service company established in 1884.

Yesterday, the company announced promotions Cheryl Haughton to vice president, new builds, transitions & major renovations and Michael Golembe to vice president of operations.

Building on its founders’ 135-year history, Donohoe Hospitality Services has grown to become one of the largest independent hotel management companies in the Washington, D.C.-metro area and is rapidly expanding throughout the U.S. Donohoe Hospitality Services’ portfolio includes full service and premium select service hotels. Donohoe Hospitality Services is approved to manage Marriott, Hilton, Intercontinental Hotel Group, Hyatt, and Choice hotel brands.

Full press release below:

Thomas Penny, III, President of Donohoe Hospitality Services, a division of Donohoe, today announced two senior promotions—Cheryl Haughton to vice president, new builds, transitions & major renovations and Michael Golembe to vice president of operations. In her new role, Haughton will be responsible for working in collaboration with Donohoe’s development team on new hotel developments and hotel openings, while overseeing acquisitions and major hotel improvements. Meanwhile, Golembe will be responsible for optimizing the company’s overall portfolio performance.

“Donohoe Hospitality Services could not have reached the heights we have today without the dedication and hard work of tireless leaders such as Cheryl and Michael,” Penny said. “With more than 50 combined years of hotel experience at virtually every position at the property level before transitioning to corporate roles, Cheryl and Michael epitomize the true spirit of hospitality. I am thankful for everything they do and look forward to both helping Donohoe continue to grow.”

Cheryl Haughton

A two decade-plus hospitality veteran, Haughton joined Donohoe Hospitality Services in 1992 and most recently was regional director of operations, full service and lifestyle hotels. Previously, she held leadership positions at six of the nation’s leading hotel brands. She served as general manager throughout Washington, DC, and operated one of the highest revenue-producing Courtyard by Marriott in the United States. Additionally, Haughton served on the Board of the Hotel Association of Washington, DC, and is a past member of the Convention Committee of Destination DC. She earned her a Bachelor of Busines Administration in Finance from George Washington University.

“I look forward to the many facets of this new position, from promoting Donohoe-sponsored and third-party, organic, ground-up development deals to supporting acquisitions and dispositions,” Haughton said. “I plan to be intimately involved with talent acquisition and will oversee operations on new hotels and acquisitions for the near future. I am eager to dive into my latest role on-boarding new hotels and working to expand and improve our existing portfolio.”

Michael Golembe

Most recently serving as regional director of operations, focused service and extended stay hotels, Golembe joined Donohoe Hospitality Services as a general manager in 2009. Over the course of his 20-plus year of hospitality career, he has come to specialize in hotel openings and turnaround projects. He has worked at multiple hotels in the full service, select service and extended stay categories along the Southeastern U.S. Golembe received his Bachelor of Science from the University of South Carolina.

“Given the current state of the hospitality industry, my immediate focus will be to work in collaboration with the executive team and the general managers to optimize our business, realize new efficiencies and stay ahead of an ever-changing and more complex business climate,” Golembe said. “Having spent the past 12 years learning and growing with Donohoe Hospitality Services, I feel well-suited for the new challenges that this new title brings with it.”

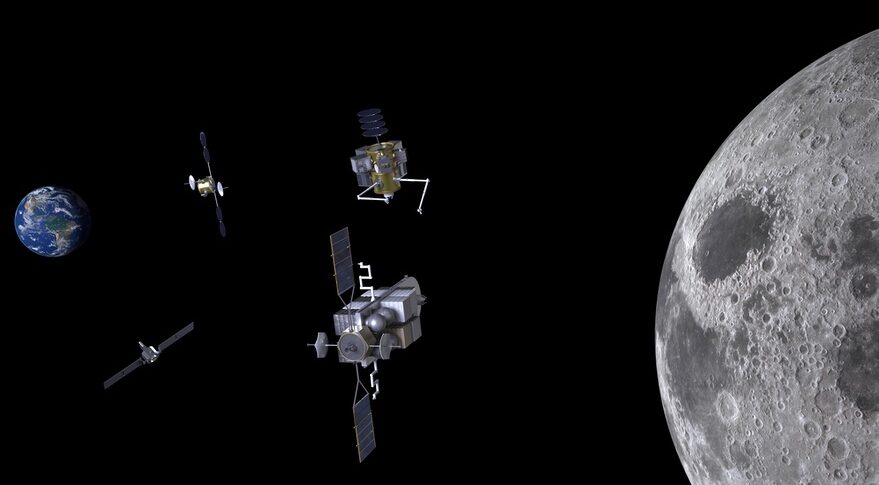

Quantum Space was founded in 2021 in Rockville by a trio of space industry veterans, Kam Ghaffarian, Steve Jurczyk, and Ben Reed. With emphasis on rapid technological advancement while lowering the cost to access cis-lunar space, the company is focused on enabling a future where innovation and sustainability meet propelling human progress, economic growth and expanding space access, and its vast ability to improve life on Earth.

Last week, Quantum Space announced place for a space venture focused on developing the first commercial lunar robotic outpost

Additional information available in the press release below:

ROCKVILLE, Md., February 3, 2022– With a focus on rapid technological advancement and lowering the cost to access cis-lunar space, a quartet of space veterans are launching Quantum Space, a commercial space infrastructure and services company aimed at disrupting the current norms of the satellite industry. At the center of the new company is an evolvable and scalable space platform, called a robotic outpost, that will serve multiple users with deploying satellites, hosting payloads and acquisition of data and logistics services via customizable missions from locations in lunar and Earth orbits.

The three co-founders are Kam Ghaffarian, a space and energy entrepreneur whose co-founded many leading new space companies, Steve Jurczyk, the former NASA Acting Administrator, and Ben Reed, former division chief of NASA’s Exploration and In-Space Services at Goddard Space Flight Center. They are joined by Kerry Wisnosky. The co-founder and former principal owner of Millennium Engineering and Integration. Each has over 30+ years of experience in aerospace developing, launching, and operating complex space systems. The trio saw a need in the market to lower operating costs, drive more rapid innovation and efficiently enable new space capabilities.

‘We envision a future where innovation and sustainability meet propelling human progress, economic growth and expanding access to space, and its vast ability to improve life on Earth. Quantum Space will be a leader in building this new future by rethinking how we approach spacecraft and space services,” said Ghaffarian, co-founder and Executive Chairman of Quantum Space, who is providing the seed funding for this new space company and has a strong background co-founding and funding successful deep-tech startups such as Axiom Space, building the world’s first commercial space station, Intuitive Machines, creating the first American Lunar Lander in 50 years, and X-energy, an advanced nuclear power company.

Founded in 2021, Quantum Space focuses on hosting and deploying payloads and providing data and logistics services from unique vantage points, such as Earth-Moon Langrage points, a critical location for economic and national security purposes. The company plans to rapidly expand space services with additional outposts at various orbits. With its modular in-space infrastructure, Quantum Space plans to be a key player in addressing space sustainability with their multi-user, mutli-mission model.

“We aim to remove barriers to entry for utilizing space to deliver more science, more data and information, strengthen national security, and accelerate commercial activities. Our business model which allows customers to purchase services on an as needed basis will enable new entrants and markets by reducing costs and allowing more rapid access to strategically important locations” said Steve Jurczyk, Co-founder and President and CEO of Quantum Space. Jurczyk, who in addition to leading America’s space agency, also served as NASA’s Associate Administrator and Associate Administrator for the Space Technology Mission Directorate.

The first mission to Earth-Moon Langrage Point 1 is slated for 2024.

Stretch Zone, the nation’s first and largest practitioner-assisted stretching company, continues expanding throughout the United States with its first Maryland location now open in the Kentlands neighborhood of Gaithersburg. Stretch Zone takes over the former GNC location at 251 Kentlands Blvd, the former home of GNC.

Stretch Zone, the company that brought practitioner-assisted stretching to the public and introduced a new vertical in the health and wellness industry, closed out 2021 with a record-breaking year of milestones, from its fastest growth of studio openings to its highest-revenue year.

The company, founded in 2004 by entrepreneur Jorden Gold, is the largest franchisor for practitioner-assisted stretching in the United States. Since its founding, Stretch Zone has opened more than 150 locations and has established a partnership with NFL legend Drew Brees, who is a multi-unit franchisee with the company.

“Stretch Zone’s swift expansion is driven by consumer demand for high quality and effective health and wellness initiatives that support aging, mobility and performance,” says founder Jorden Gold. “In 2021 alone, the company expanded into 10 states, and we have an abundance of studio openings in key and unique markets planned for this year in an effort to continue growing our brand’s footprint nationwide and beyond.”

Stretch Zone’s growing list of studio locations included many new markets in addition to the new Kentlands location, including Anchorage, AK; Aspen, CO; Gainesville, FL; Zionsville, IN; New Orleans, LA; Chesterfield, MO; and Manhasset, NY.

This rapid expansion drove Stretch Zone’s highest revenue year. The company also received recognition by Entrepreneur Magazine (2022 Franchise 500), FranchiseBusinessREVIEW (Top Multi-Unit Franchisee, Top Franchises for Veterans, and Top Franchise for 2022), and South Florida Business & Wealth (Apogee Awards).

“Stretch Zone represents a transformative health and wellness company for people of all ages, backgrounds and abilities,” says Tony Zaccario, President of Stretch Zone. “Our model and proprietary system deliver success for our franchise partners, which are supported by a network of reliable, adaptable and results-driven professionals. Stretch Zone is a resilient business that has continued to flourish during these unusual times.”

In response to the increased demand for scientifically backed wellness programs, Stretch Zone continues its rapid expansion and anticipates growing to 250 studio locations by the end of 2022, including Boston, MA; New York City, NY; and Rancho Palos Verdes, CA; as well as international entry into Canada.

Bellwether Enterprise Real Estate Capital LLC (BWE), the commercial and multifamily mortgage banking subsidiary of Enterprise Community Investment Inc. (Enterprise), announced in January that it acquired Bethesda-based, Phillips Realty Capital (Phillips).

Based in Bethesda, with offices in Alexandria, Charlottesville and Richmond, VA, Phillips has been a fixture in the Washington, D.C. real estate community for 85 years. Led by C. Stephen Shaw, Jr., now executive vice president, the team of experienced commercial real estate finance professionals will now be part of a national, privately-owned platform that will provide expanded financing solutions for its clients.

“Shaw and his team have deep roots in the D.C. region’s commercial real estate market and a strong culture like ours,” said DJ Effler, president of BWE. “The team is an ideal partner for BWE, and we are thrilled to have them join as our largest production office.”

Shaw and his team have historically originated over $1.5 billion in annual production, with total volume for 2021 expected to hit $1.9 billion thanks to a focus on multi-family lending and strong borrower relationships.

Shaw, who served as president and CEO of Phillips, has structured and originated over $10 billion in commercial real estate financing during his 40-plus-year career. In addition to his roles in investor relations, strategic development and structuring new business opportunities, Shaw serves on the board of directors for several companies.

“Our team has developed deep personal relationships with its debt and equity clients over the years,” said Shaw. “With direct access to Fannie, Freddie and FHA lending, as well as extensive life company, CMBS, bank and debt fund relationships, we look forward to using BWE’s national platform to share new opportunities with our client partners. Additionally, BWE has a proprietary bridge lending program that we are excited to offer to borrowers.”

John R. Sieber, executive vice president, Daniel S. Shiff, senior vice president, Joseph C. Tilley, director of financial operations, David C. Foulk, senior vice president, William Wrench, vice president, Mark Remington, senior vice president, Adam Bieber, senior vice president and Charles DuBose, senior vice president, are among the 20 employees who will also join the BWE team.

From Phillips Realty Capital:

“We are pleased to share exciting news that today BWE (Bellwether Enterprise) announced their acquisition of Phillips Realty Capital. BWE is a national, full-service commercial and multifamily mortgage banking company with 30 production offices across the country and an integrated servicing platform based in Cleveland. It is employee-owned and a subsidiary of Enterprise Community Investment, a national nonprofit investing in, creating and preserving affordable homes in diverse communities across the country.

Continuity and culture are as important to BWE as they are to us. We want you to know that we are the same people, with the same approach, now part of something bigger.”

It has been just under a year since Bark Social opened its gates in Pike & Rose, adjacent to Rose Park and next to Julii and Jinya. BizJournals reports that the “social club for dogs and their owners has raised another $2 million to fuel its growth in Greater Washington and other metro areas along the East Coast.” Per the report, it’s the latest of three funding rounds for the company, for a total of around $5.3 million. Bark Social will start with a new location in Baltimore (Canton) and plan on at least two more locations in D.C. and Philadelphia to be announced soon.

The existing venue consists of a 25,000 square foot dog park plus a 2,500 square foot climate controlled clubhouse as well as a bar/cafe and gift shop. The dog park is off-leash and monitored by trained professionals at all times and there is a separate area for small dogs as well.

Their outdoor area is spacious– it has ample, physically distanced seating for humans and lots of room for dogs to play around. They have a covered outdoor patio with heating, an uncovered area, an indoor clubhouse, and they also brought back the Pike & Rose beach on their premises due to popular request.

New solar PV system will generate 20% of the office building’s electricity needs each year

Yesterday, The Tower Companies and Prospect Solar, LLC announced that The Tower Building, located at 1101 Wootton Parkway in Rockville, flipped the switch on Tower’s largest on-site solar photovoltaic (PV) system. The project is also the largest solar PV Canopy installation in the City of Rockville and will contribute to Maryland’s long-term goal of net-zero GHG emissions by 2045.

In a statement from City of Rockville’s Mayor Bridget Donnell Newton, she said that “the installation of the solar carport and electric vehicle charging stations at 1101 Wootton Parkway is especially timely given Rockville’s work to approve our first Climate Action Plan. This is a great, innovative project that shows how Rockville businesses are contributing to clean, local renewable energy generation and helping our community meet our greenhouse gas reduction goals. We are proud that our city is home to companies like Tower that share the values of our community and are taking proactive approaches to help us meet Rockville’s climate action goals.”

The Tower Companies is a privately held and family-owned sustainable and healthy building leader that developed 1101 Wootton Parkway in 2001, continuing to own and manage the property today. The 290,000 SF, 10-story multi-tenant commercial office building is LEED® Gold Certified under Existing Buildings: Operations and Maintenance. The building is also ENERGY STAR Certified with a score of 84, which means that its energy performance is in the top 16 percent of similar buildings nationwide.

“Tower is proud to continue our long-standing commitment to sustainability and contribute to local, state, and national climate action goals that will improve the lives of generations to come” said Eric Posner, The Tower Companies’ Chief Operating Officer. “We view this project as a smart investment that not only benefits the environment but is also a real value-add for our office building tenants. These solar panels will directly improve building performance, reduce operating costs, and take pressure off the electricity grid, yielding clean and reliable energy. We hope our work will inspire other building owners to take similar action.”

Project Details:

The new half megawatt solar PV canopy system features 1,318 (435-watt) American-made panels in the adjacent parking lot, with an estimated annual production of nearly 690,000 kWh, or 20 percent of the total building energy demand. The onsite clean energy generated will be equivalent to the amount of carbon offset by 600 acres of U.S. forests annually. The project also included the installation of 4 new electric vehicle stations. Gregorio Sustainability LLC advised on, developed, and helped manage the project for The Tower Companies. Prospect Solar, a Virginia-based solar provider, designed and installed the 573-kW solar PV system. A blog about the project was posted by the Montgomery County

Department of Environmental Protection to share highlights about implementation and other partners that made it a success.

“Tower’s leadership on this project continues to prove that distributed renewable energy plays a major role in the future of new and existing buildings” said Andrew Skinner, VP of Prospect Solar.

The Tower Companies worked closely with the Maryland Energy Administration (MEA) to receive a generous grant from the Parking Lot Solar Photovoltaic Canopy with Electric Vehicle Charger Program. Tower is excited that this project will help make progress towards the State of Maryland’s Greenhouse Gas Emissions Reduction (GGRA) Act, which aims to reduce greenhouse gas emissions 50 percent by 2030 and reach net zero emissions by 2045. The Tower Companies shares the same climate targets, aligned with a commitment to ULI Greenprint and the Paris Agreement.

“Solar canopies are an excellent way to provide a dual purpose to land used for parking” said Mary Beth Tung, Director of the Maryland Energy Administration. “In addition to keeping cars cool and protected from the elements, the solar panels provide clean, renewable electricity to reduce the need for grid supplied electricity, while four onsite charging stations provide opportunities for employees and visitors to power their electric vehicles.”

Tower’s On-Site Renewable Energy Program

In 2014, The Tower Companies completed the largest installation in Washington, D.C. on a Class A commercial office building and didn’t stop there. This carport installation is Tower’s fifth on-site solar project – and largest to date. By June 2022, Tower will be generating almost 2 million kWh of on-site solar energy across its portfolio using approximately 4,000 solar panels. 5% of Tower’s total annual electricity demand will come directly from the sun. Through energy efficiency efforts, including on-site clean energy projects like this one, Tower has reduced energy consumption by more than 25% across the portfolio since 2010.

About The Tower Companies: For three generations, the family-owned Tower Companies has maintained a commitment to responsible development and continues to envision a world where buildings inspire and enrich the lives of their occupants and create positive social change. Tower owns and manages over 6 million square feet in the Washington, D.C. metropolitan area consisting of office buildings, retail shopping centers, lifestyle centers, and residential eco-progressive live-work-play communities, with an additional 13 million square feet in the development pipeline. In 2004, Tower was the first in the U.S. to achieve LEED® certification at a multi-family property and has gone on to achieve LEED® certification for 95 percent, ENERGY STAR® for 80 percent, and Fitwel® or Fitwel® VR for 95% of their commercial office and multi-family portfolio. As part of their commitment to healthy buildings, Tower is also proud to be the first building owner in the country using two innovative technologies centered on creating and monitoring indoor environmental quality for occupants. Tower has been carbon neutral since 2010; publicly reporting their portfolio’s carbon footprint to The Climate Registry and offsetting 100 percent of GHG emissions by supporting renewable energy projects in North America.

About Prospect Solar: Prospect Solar, LLC was established in 2010 as the professional’s choice for design-build solar photovoltaic energy system installation. They draw from the construction industry experiences of their sister company, Prospect Waterproofing Company. A foundation of more than 25 years of roofing and waterproofing expertise allows Prospect Solar to provide clients with exceptional quality and value. Prospect Solar’s turnkey service is as sustainable as their business model, and continual investments in solar training, certifications, and oversight ensure the safest possible installations. Prospect’s services include engineering, economic analysis, financing, monitoring, and custom installations.

The United States Department of Defense announced the contract awarded to Bethesda’s Lockheed Martin

Lockheed Martin, which is headquartered in Montgomery County, has been awarded a $1,420,000,000 indefinite-delivery/indefinite-quantity contract for the C-130J mission sustainment support effort.

This contract provides for contractor logistics support and sustainment of the C-130J aircraft fleet. Work will be performed in Marietta, Georgia, and is expected to be completed by Jan. 31, 2032.

This award is the result of a sole source acquisition. Fiscal 2022 operations and maintenance funds in the amount of $91,023,138 are being obligated at the time of award. Air Force Life Cycle Management Center, Robins Air Force Base, Georgia, is the contracting activity (FA8504-22-D-0001).

Earlier this morning, we reported Lockheed Martin’s fourth quarter and full year 2021 financial results.

– Net sales of $17.7 billion in the fourth quarter and $67.0 billion in 2021

– Net earnings from continuing operations of $2.0 billion, or $7.47 per share, in the fourth quarter and $6.3 billion, or $22.76 per share, in 2021

– Generated cash from operations of $4.3 billion in the fourth quarter and $9.2 billion in 2021

– Returned cash to shareholders through $2.1 billion of share repurchases and $762 million of dividends in the fourth quarter, and $4.1 billion of share repurchases and $2.9 billion of dividends in 2021

– 2022 financial outlook provided

Per Lockheed Martin:

Lockheed Martin Corporation [NYSE: LMT] today reported fourth quarter 2021 net sales of $17.7 billion, compared to $17.0 billion in the fourth quarter of 2020. Net earnings from continuing operations in the fourth quarter of 2021 were $2.0 billion, or $7.47 per share, compared to $1.8 billion, or $6.38 per share, in the fourth quarter of 2020. Cash from operations was $4.3 billion in the fourth quarter of 2021, compared to $1.8 billion in the fourth quarter of 2020. Cash from operations in the fourth quarter of 2020 was after $1.0 billion of discretionary pension contributions.

“We closed the year on a strong note with solid growth in fourth quarter sales, segment operating profit, and earnings per share, while cash exceeded our projections as we delivered on our customer commitments and drove strong execution,” said Lockheed Martin Chairman, President and CEO James Taiclet. “We delivered significant value back to shareholders in 2021, including $7 billion in dividends and share repurchases, and our team continued to provide world-class support to our customers despite the ongoing challenges of the global pandemic. Through our strong balance sheet, we continue to invest in the many emerging growth opportunities ahead – from new aircraft competitions around the world, to our classified portfolio, to solid demand for our signature programs, to emerging technologies like hypersonics. Looking ahead to 2022, we will remain fully dedicated to service to our customers and dynamic and disciplined capital allocation for the benefit of our shareholders.”

Net earnings for the quarter ended Dec. 31, 2021, included net gains of $85 million ($64 million, or $0.23 per share, after-tax) due to increases in the fair value of investments held in the Lockheed Martin Ventures Fund. Net earnings for the year ended Dec. 31, 2021, included a noncash pension settlement charge of $1.7 billion ($1.3 billion, or $4.72 per share, after-tax) associated with the $4.9 billion gross pension liability transfer completed in the third quarter; net gains of $265 million ($199 million, or $0.72 per share, after-tax) due to increases in the fair value of investments held in the Lockheed Martin Ventures Fund; and severance and restructuring charges of $36 million ($28 million, or $0.10 per share, after-tax) announced in the first quarter. Net earnings for the year ended Dec. 31, 2020, included a non-cash impairment charge of $128 million ($96 million, or $0.34 per share, after tax) for an investment in a joint venture; and severance charges of $27 million ($21 million, or $0.08 per share, after-tax).

Update on Proposed Aerojet Rocketdyne Acquisition

Earlier this month, Lockheed Martin and Aerojet Rocketdyne agreed with the Federal Trade Commission (FTC) that the parties would not close the transaction before Jan. 27, 2022, to enable the parties to discuss the scope and nature of the merchant supply and firewall commitments previously offered by Lockheed Martin. Lockheed Martin has been advised by the FTC that its concerns regarding the transaction cannot be addressed adequately by the terms of a consent order. Lockheed Martin believes it is highly likely that the FTC will vote to sue to block the transaction and expects they will make a decision before Jan. 27, 2022.

If the FTC sues to block the transaction, Lockheed Martin could elect to defend the lawsuit or terminate the merger agreement. Additional information concerning the transaction can be found in Lockheed Martin’s 2021 Form 10-K that has been filed with the Securities and Exchange Commission.

Lockheed Martin continues to believe in the benefits of the transaction for the United States and its allies, the industry, and all of the company’s stakeholders.

Summary Financial Results

The following table presents the company’s summary financial results.

|

(in millions, except per share data) |

Quarters Ended Dec. 31, |

Years Ended Dec. 31, |

||||||||

|

2021 |

2020 |

2021 |

2020 |

|||||||

|

Net sales |

$ 17,729 |

$ 17,032 |

$ 67,044 |

$ 65,398 |

||||||

|

Business segment operating profit1 |

$ 2,014 |

$ 1,875 |

$ 7,379 |

$ 7,152 |

||||||

|

Unallocated items |

||||||||||

|

FAS/CAS operating adjustment |

491 |

469 |

1,960 |

1,876 |

||||||

|

Severance and restructuring charges2 |

— |

(27) |

(36) |

(27) |

||||||

|

Other, net3 |

(50) |

(28) |

(180) |

(357) |

||||||

|

Total unallocated items |

441 |

414 |

1,744 |

1,492 |

||||||

|

Consolidated operating profit |

$ 2,455 |

$ 2,289 |

$ 9,123 |

$ 8,644 |

||||||

|

Net earnings (loss) from |

||||||||||

|

Continuing operations2,3,4 |

$ 2,049 |

$ 1,792 |

$ 6,315 |

$ 6,888 |

||||||

|

Discontinued operations5 |

— |

— |

— |

(55) |

||||||

|

Net earnings |

$ 2,049 |

$ 1,792 |

$ 6,315 |

$ 6,833 |

||||||

|

Diluted earnings (loss) per share from |

||||||||||

|

Continuing operations2,3,4 |

$ 7.47 |

$ 6.38 |

$ 22.76 |

$ 24.50 |

||||||

|

Discontinued operations5 |

— |

— |

— |

(0.20) |

||||||

|

Diluted earnings per share |

$ 7.47 |

$ 6.38 |

$ 22.76 |

$ 24.30 |

||||||

|

Cash from operations6 |

$ 4,268 |

$ 1,807 |

$ 9,221 |

$ 8,183 |

||||||

|

1 |

Business segment operating profit is a non-GAAP measure. See the “Use of Non-GAAP Financial Measures” section of this news release for more information. |

|||||||||

|

2 |

Severance and restructuring charges for the year ended Dec. 31, 2021 include charges of $36 million ($28 million, or $0.10 per share, after-tax) for previously announced actions at the company’s Rotary and Mission Systems business segment recognized in the first quarter of 2021. Severance and restructuring charges for the quarter and year ended Dec. 31, 2020 include charges of $27 million ($21 million, or $0.08 per share, after-tax) for previously announced actions related to corporate functions. |

|||||||||

|

3 |

Other, net for the year ended Dec. 31, 2020 includes a noncash impairment charge of $128 million ($96 million, or $0.34 per share, after-tax) for the investment in the international equity method investee, Advanced Military Maintenance, Repair and Overhaul Center (AMMROC) recognized in the second quarter of 2020. |

|||||||||

|

4 |

Net earnings from continuing operations for the quarter and year ended Dec. 31, 2021 include net gains of $85 million ($64 million, or $0.23 per share, after-tax) and $265 million ($199 million, or $0.72 per share, after-tax) due to increases in the fair value of investments held in the Lockheed Martin Ventures Fund. Net earnings from continuing operations for the year ended Dec. 31, 2021 also include a previously announced noncash, non-operating pension settlement charge of $1.7 billion ($1.3 billion, or $4.72 per share, after-tax) related to the purchase of group annuity contracts to transfer $4.9 billion of gross pension obligations to an insurance company in the third quarter of 2021. |

|||||||||

|

5 |

Net earnings from discontinued operations for the year ended Dec. 31, 2020 include a noncash charge in the third quarter of 2020 for $55 million ($0.20 per share) resulting from the resolution of certain tax matters related to the former Information Systems & Global Solutions business divested in 2016. |

|||||||||

|

6 |

Cash from operations for the year ended Dec. 31, 2021 is after employer payroll tax payments of $942 million, compared to $222 million for the year ended Dec. 31, 2020. In 2020, the company deferred the payment of $460 million of the employer portion of payroll taxes pursuant to the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), of which $230 million was paid in the fourth quarter of 2021 with the remaining $230 million to be paid in the fourth quarter of 2022. In addition, cash from operations for the quarter and year ended Dec. 31, 2020 is net of discretionary pension contributions of $1.0 billion. |

|||||||||

2022 Financial Outlook

The following table and other sections of this news release contain forward-looking statements, which are based on the company’s current expectations. Actual results may differ materially from those projected. It is the company’s practice not to incorporate adjustments into its financial outlook for proposed acquisitions, divestitures, ventures, pension risk transfer transactions, changes in law, or new accounting standards until such items have been consummated, enacted or adopted. For additional factors that may impact the company’s actual results, refer to the “Forward-Looking Statements” section in this news release.

|

(in millions, except per share data) |

2022 |

|||

|

Net sales |

~$66,000 |

|||

|

Business segment operating profit2 |

~$7,175 |

|||

|

Net FAS/CAS pension adjustment3,4 |

~$2,260 |

|||

|

Diluted earnings per share |

~$26.70 |

|||

|

Cash from operations |

≥$7,900 |

|||

|

R&D capitalization assumption5 |

~$500 |

|||

|

Cash from operations (excluding R&D)2 |

≥$8,400 |

|||

|

Cash from operations |

≥$7,900 |

|||

|

Capital expenditures |

~$(1,900) |

|||

|

Free cash flow2 |

≥$6,000 |

|||

|

1 |

The company’s current 2022 financial outlook reflects known impacts from the COVID-19 pandemic based on the company’s understanding at the time of this news release and its experience to date. However, the company cannot predict how the pandemic will evolve or what impact it will continue to have. Therefore, no additional impacts to the company’s operations or its supply chain as a result of continued disruption from, or policies in response to, COVID-19 for periods subsequent to the time of this news release have been incorporated into the company’s current 2022 financial outlook. The ultimate impacts of COVID-19 on the company’s financial results for 2022 and beyond remain uncertain and there can be no assurance that the company’s underlying assumptions are correct. Additionally, the current 2022 financial outlook does not include any future gains or losses related to changes in valuations of the company’s investments held in the Lockheed Martin Ventures Fund as the company cannot predict changes in the valuation of its investments or market events. It also assumes continued accelerated payments to suppliers, with a focus on small and at-risk businesses. Further, the 2022 financial outlook does not incorporate the pending acquisition of Aerojet Rocketdyne Holdings, Inc. and related transaction costs. |

|||

|

2 |

Business segment operating profit, cash from operations (excluding R&D) and free cash flow are non-GAAP measures. See the “Use of Non-GAAP Financial Measures” section of this news release for more information. |

|||

|

3 |

The net FAS/CAS pension adjustment is presented as a single amount and includes total expected U.S. Government cost accounting standards (CAS) pension cost of approximately $1.8 billion and total expected financial accounting standards (FAS) pension income of approximately $460 million. CAS pension cost and the service cost component of FAS pension income are included in operating profit. The non-service cost components of FAS pension income are included in non-operating income (expense). For additional detail regarding the pension amounts reported in operating and non-operating results, refer to the supplemental table included at the end of this news release. |

|||

|

4 |

The net FAS/CAS pension adjustment was calculated using a 2.875% discount rate at Dec. 31, 2021, an approximate 10.5% return on plan assets in 2021, and an expected 6.5% long-term rate of return on plan assets in future years. |

|||

|

5 |

A provision of the Tax Cuts and Jobs Act of 2017 went into effect on Jan. 1, 2022 that requires companies to capitalize and amortize research and development costs over five years rather than deducting such costs in the year incurred for tax purposes. The company currently estimates that unless the provision is deferred, modified, or repealed, this change will result in an additional $500 million of tax payments in 2022, which has been reflected in the company’s current 2022 financial outlook for cash from operations. This change is not expected to have a significant impact on the company’s net earnings. |

|||

Cash Deployment Activities

The company’s cash deployment activities in the quarter and year end Dec. 31, 2021, included the following:

- accelerating $2.2 billion of payments to suppliers during the quarter ended Dec. 31, 2021, that were due in the first quarter of 2022, compared to accelerating $2.1 billion of payments to suppliers in the fourth quarter of 2020 that were due in the first quarter of 2021;

- making no pension contributions during the quarter and year ended Dec. 31, 2021, compared to making discretionary pension contributions of $1.0 billion during the quarter and year ended Dec. 31, 2020;

- making capital expenditures of $607 million and $1.5 billion during the quarter and year ended Dec. 31, 2021, compared to $722 million and $1.8 billionduring the quarter and year ended Dec. 31, 2020;

- paying cash dividends of $762 million and $2.9 billion during the quarter and year ended Dec. 31, 2021, compared to $728 million and $2.8 billion during the quarter and year ended Dec. 31, 2020;

- paying $2.1 billion to repurchase 6.1 million shares (including 2.2 million shares received upon settlement of an accelerated share repurchase agreement (ASR) in January 2022) and $4.1 billion to repurchase 11.7 million shares (including the 2.2 million shares received upon settlement of an ASR in January 2022) during the quarter and year ended Dec. 31, 2021, compared to no shares repurchased and paying $1.1 billion to repurchase 3.0 million shares during the quarter and year ended Dec. 31, 2020;

- making no repayments and a scheduled repayment of $500 million of long-term debt during the quarter and year ended Dec. 31, 2021, compared to making repayments of $500 million and $1.7 billion of long-term debt during the quarter and year ended Dec. 31, 2020; and

- receiving no proceeds from the issuance of debt during the year ended Dec. 31, 2021, compared to receiving $1.1 billion of net proceeds from the issuance of debt during the year ended Dec. 31, 2020.

Segment Results

The company operates in four business segments organized based on the nature of products and services offered: Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS) and Space. The following table presents summary operating results of the company’s business segments and reconciles these amounts to the company’s consolidated financial results.

|

(in millions) |

Quarters Ended Dec. 31, |

Years Ended Dec. 31, |

||||||||

|

2021 |

2020 |

2021 |

2020 |

|||||||

|

Net sales |

||||||||||

|

Aeronautics |

$ 7,127 |

$ 6,714 |

$ 26,748 |

$ 26,266 |

||||||

|

Missiles and Fire Control |

3,219 |

2,866 |

11,693 |

11,257 |

||||||

|

Rotary and Mission Systems |

4,460 |

4,212 |

16,789 |

15,995 |

||||||

|

Space |

2,923 |

3,240 |

11,814 |

11,880 |

||||||

|

Total net sales |

$ 17,729 |

$ 17,032 |

$ 67,044 |

$ 65,398 |

||||||

|

Operating profit |

||||||||||

|

Aeronautics |

$ 820 |

$ 727 |

$ 2,799 |

$ 2,843 |

||||||

|

Missiles and Fire Control |

438 |

374 |

1,648 |

1,545 |

||||||

|

Rotary and Mission Systems |

448 |

406 |

1,798 |

1,615 |

||||||

|

Space |

308 |

368 |

1,134 |

1,149 |

||||||

|

Total business segment operating profit |

2,014 |

1,875 |

7,379 |

7,152 |

||||||

|

Unallocated items |

||||||||||

|

FAS/CAS operating adjustment |

491 |

469 |

1,960 |

1,876 |

||||||

|

Severance and restructuring charges |

— |

(27) |

(36) |

(27) |

||||||

|

Other, net |

(50) |

(28) |

(180) |

(357) |

||||||

|

Total unallocated items |

441 |

414 |

1,744 |

1,492 |

||||||

|

Total consolidated operating profit |

$ 2,455 |

$ 2,289 |

$ 9,123 |

$ 8,644 |

||||||

Net sales and operating profit of the company’s business segments exclude intersegment sales, cost of sales, and profit as these activities are eliminated in consolidation. Operating profit of the company’s business segments includes the company’s share of earnings or losses from equity method investees as the operating activities of the investees are closely aligned with the operations of its business segments.

Operating profit of the company’s business segments also excludes the FAS/CAS pension operating adjustment described below, a portion of corporate costs not considered allowable or allocable to contracts with the U.S. Government under the applicable U.S. Government cost accounting standards (CAS) or federal acquisition regulations (FAR), and other items not considered part of management’s evaluation of segment operating performance such as a portion of management and administration costs, legal fees and settlements, environmental costs, stock-based compensation expense, retiree benefits, significant severance actions, significant asset impairments, gains or losses from divestitures, and other miscellaneous corporate activities.

The company recovers CAS pension cost through the pricing of its products and services on U.S. Government contracts and, therefore, recognizes CAS pension cost in each of its business segments’ net sales and cost of sales. The company’s consolidated financial statements must present pension and other postretirement benefit plan income calculated in accordance with FAS requirements under U.S. generally accepted accounting principles. The operating portion of the net FAS/CAS pension adjustment represents the difference between the service cost component of FAS pension (expense) income and total CAS pension cost. The non-service FAS pension (expense) income component is included in other non-service FAS pension (expense) income in our consolidated statements of earnings. The net FAS/CAS pension adjustment increases or decreases CAS pension cost to equal total FAS pension income (both service and non-service).

Changes in net sales and operating profit generally are expressed in terms of volume. Changes in volume refer to increases or decreases in sales or operating profit resulting from varying production activity levels, deliveries or service levels on individual contracts. Volume changes in segment operating profit are typically based on the current profit booking rate for a particular contract. In addition, comparability of the company’s segment sales, operating profit and operating margin may be impacted favorably or unfavorably by changes in profit booking rates on the company’s contracts for which it recognizes revenue over time using the percentage-of-completion cost-to-cost method to measure progress towards completion. Increases in profit booking rates, typically referred to as risk retirements, usually relate to revisions in the estimated total costs to fulfill the performance obligations that reflect improved conditions on a particular contract. Conversely, conditions on a particular contract may deteriorate, resulting in an increase in the estimated total costs to fulfill the performance obligations and a reduction in the profit booking rate. Increases or decreases in profit booking rates are recognized in the current period and reflect the inception-to-date effect of such changes.

Segment operating profit and margin may also be impacted favorably or unfavorably by other items, which may or may not impact sales. Favorable items may include the positive resolution of contractual matters, cost recoveries on severance and restructuring charges, insurance recoveries and gains on sales of assets. Unfavorable items may include the adverse resolution of contractual matters; restructuring charges, except for significant severance actions which are excluded from segment operating results; reserves for disputes; certain asset impairments; and losses on sales of certain assets.

The company’s consolidated net adjustments not related to volume, including net profit booking rate adjustments, represented approximately 29% and 28% of total segment operating profit in the quarter and year ended Dec. 31, 2021, as compared to 25% and 26% in the quarter and year ended Dec. 31, 2020.

Aeronautics

|

(in millions) |

Quarters Ended Dec. 31, |

Years Ended Dec. 31, |

||||||||||||

|

2021 |

2020 |

2021 |

2020 |

|||||||||||

|

Net sales |

$ 7,127 |

$ 6,714 |

$ 26,748 |

$ 26,266 |

||||||||||

|

Operating profit |

820 |

727 |

2,799 |

2,843 |

||||||||||

|

Operating margin |

11.5 |

% |

10.8 |

% |

10.5 |

% |

10.8 |

% |

||||||

Aeronautics’ net sales during the fourth quarter of 2021 increased $413 million, or 6%, compared to the same period in 2020. The increase was primarily attributable to higher net sales of approximately $270 million for the F-35 program due to higher volume on production contracts that was partially offset by lower volume on development contracts; and about $110 million for classified contracts due to higher volume and risk retirements.

Aeronautics’ operating profit during the fourth quarter of 2021 increased $93 million, or 13%, compared to the same period in 2020. The increase was primarily attributable to higher operating profit of approximately $55 million for classified contracts due to higher risk retirements; and about $35 million for the C-130 program due to higher risk retirements on sustainment activities. Operating profit for the F-35 program was comparable as higher volume on production contracts was offset by lower risk retirements on sustainment contracts. Adjustments not related to volume, including net profit booking rate adjustments, were $80 million higher in the fourth quarter of 2021 compared to the same period in 2020.

Aeronautics’ net sales in 2021 increased $482 million, or 2%, compared to 2020. The increase was primarily attributable to higher net sales of approximately $290 million on classified contracts due to higher volume; about $180 million for the F-16 program due to higher volume on production contracts that was partially offset by lower sustainment volume; approximately $75 million for the F-35 program primarily due to higher volume on production and sustainment contracts that was partially offset by lower volume on development contracts; and about $30 million for the C-130 program primarily due to higher volume on production contracts and higher risk retirements on sustainment activities. These increases were partially offset by a decrease of approximately $170 million for lower sustainment volume for the F-22 program.

Aeronautics’ operating profit in 2021 decreased $44 million, or 2%, compared to 2020. The decrease was primarily attributable to lower operating profit of approximately $120 million for classified contracts primarily due to a $225 million loss recognized in the second quarter of 2021 for performance issues experienced on a classified program that was partially offset by higher risk retirements on other classified programs recognized in the second half of 2021; and about $70 million for the F-35 program due to lower risk retirements and volume on development contracts and lower risk retirements on production contracts that were partially offset by higher risk retirements and volume on sustainment contracts. These decreases were partially offset by an increase of approximately $90 million for the C-130 program due to higher risk retirements on sustainment contracts; and about $50 million for the F-16 program due to higher risk retirements on sustainment contracts and higher production volume. Adjustments not related to volume, including net profit booking rate adjustments, were $60 million lower in 2021 compared to 2020.

Missiles and Fire Control

|

(in millions) |

Quarters Ended Dec. 31, |

Years Ended Dec. 31, |

||||||||||||

|

2021 |

2020 |

2021 |

2020 |

|||||||||||

|

Net sales |

$ 3,219 |

$ 2,866 |

$ 11,693 |

$ 11,257 |

||||||||||

|

Operating profit |

438 |

374 |

1,648 |

1,545 |

||||||||||

|

Operating margin |

13.6 |

% |

13.0 |

% |

14.1 |

% |

13.7 |

% |

||||||

MFC’s net sales during the fourth quarter of 2021 increased $353 million, or 12%, compared to the same period in 2020. The increase was primarily attributable to higher net sales of approximately $200 million for integrated air and missile defense programs due to higher volume (primarily PAC-3); and about $190 million for tactical and strike missile programs due to higher volume (primarily Hellfire, Long Range Anti-Ship Missile (LRASM) and Joint Air-to-Surface Standoff Missile (JASSM)). These increases were partially offset by a decrease of about $40 million for sensors and global sustainment programs due to lower volume (primarily Special Operations Forces Global Logistics Support Services (SOF GLSS)).

MFC’s operating profit during the fourth quarter of 2021 increased $64 million, or 17%, compared to the same period in 2020. The increase was primarily attributable to higher operating profit of approximately $40 million for tactical and strike missile programs due to higher volume (primarily Hellfire, LRASM and JASSM) and higher risk retirements (primarily Guided Multiple Launch Rocket Systems (GMLRS)); and about $25 million for integrated air and missile defense programs due to higher volume (primarily PAC-3). Adjustments not related to volume, including net profit booking rate adjustments, were comparable in the fourth quarter of 2021 to the same period in 2020.

MFC’s net sales in 2021 increased $436 million, or 4%, compared to 2020. The increase was primarily attributable to higher net sales of approximately $340 million for integrated air and missile defense programs due to higher volume and risk retirements (primarily PAC-3); and about $215 million for tactical and strike missile programs due to higher volume (primarily LRASM and JASSM). These increases were partially offset by a decrease of approximately $90 million for sensors and global sustainment programs due to lower volume (primarily Sniper Advanced Targeting Pod (SNIPER®) and Apache) that was partially offset by close out activities related to the Warrior Capability Sustainment Program (Warrior) that was terminated by the customer in March 2021.

MFC’s operating profit in 2021 increased $103 million, or 7%, compared to 2020. The increase was primarily attributable to higher operating profit of approximately $65 million for integrated air and missile defense programs due to higher risk retirements and volume (primarily PAC-3); about $45 million for tactical and strike missile programs due to higher volume (primarily LRASM and JASSM) and higher risk retirements (primarily GMLRS); and approximately $20 million for sensors and global sustainment programs due to the reversal of a portion of previously recorded losses on the Warrior program in the second and third quarters of 2021 that will not recur as a result of the program being terminated, which was partially offset by lower volume (primarily SNIPER and Apache). These increases were partially offset by charges of approximately $25 million due to performance issues on an energy program during the third quarter of 2021. Adjustments not related to volume, including net profit booking rate adjustments, were $85 million higher in 2021 compared to 2020.

Rotary and Mission Systems

|

(in millions) |

Quarters Ended Dec. 31, |

Years Ended Dec. 31, |

||||||||||||

|

2021 |

2020 |

2021 |

2020 |

|||||||||||

|

Net sales |

$ 4,460 |

$ 4,212 |

$ 16,789 |

$ 15,995 |

||||||||||

|

Operating profit |

448 |

406 |

1,798 |

1,615 |

||||||||||

|

Operating margin |

10.0 |

% |

9.6 |

% |

10.7 |

% |

10.1 |

% |

||||||

RMS’ net sales during the fourth quarter of 2021 increased $248 million, or 6%, compared to the same period in 2020. The increase was primarily attributable to higher net sales of approximately $115 million for various C6ISR (command, control, communications, computers, cyber, combat systems, intelligence, surveillance, and reconnaissance) programs due to higher volume; about $70 million for training and logistics solutions (TLS) programs due to higher volume; and approximately $45 million for integrated warfare systems and sensors (IWSS) programs due to higher volume on Canadian Surface Combatant (CSC) and Aegis programs.

RMS’ operating profit during the fourth quarter of 2021 increased $42 million, or 10%, compared to the same period in 2020. The increase was primarily attributable to higher operating profit of approximately $30 million for Sikorsky helicopter programs due to higher risk retirements (primarily Combat Rescue Helicopter (CRH) and VH-92A); and about $20 million for C6ISR programs due to higher risk retirements. Adjustments not related to volume, including net profit booking rate adjustments, were $10 million higher in the fourth quarter of 2021 compared to the same period in 2020.

RMS’ net sales in 2021 increased $794 million, or 5%, compared to 2020. The increase was primarily attributable to higher net sales of $540 million for Sikorsky helicopter programs due to higher production volume (Black Hawk, CH-53K and CRH); and about $340 million for TLS programs primarily due to the delivery of an international pilot training system in the first quarter of 2021. These increases were partially offset by lower net sales of about $65 million for IWSS programs due to lower volume on the LCS and TPQ-53 programs that were partially offset by higher volume on the CSC and Aegis programs.

RMS’ operating profit in 2021 increased $183 million, or 11%, compared to 2020. The increase was primarily attributable to higher operating profit of approximately $140 million for Sikorsky helicopter programs due to higher risk retirements (Black Hawk and CH-53K), higher production volume (Black Hawk and CRH), and lower charges on the CRH program in the first half of 2021; and about $10 million for TLS programs due to the delivery of an international pilot training system in the first quarter of 2021. Operating profit for IWSS programs was comparable as lower risk retirements on the LCS program and lower volume on the TPQ-53 program were offset by higher volume on the CSC program and lower charges on a ground-based radar program. Adjustments not related to volume, including net profit booking rate adjustments, were $80 million higher in 2021 compared 2020.

Space

|

(in millions) |

Quarters Ended Dec. 31, |

Years Ended Dec. 31, |

||||||||||||

|

2021 |

2020 |

2021 |

2020 |

|||||||||||

|

Net sales |

$ 2,923 |

$ 3,240 |

$ 11,814 |

$ 11,880 |

||||||||||

|

Operating profit |

308 |

368 |

1,134 |

1,149 |

||||||||||

|

Operating margin |

10.5 |

% |

11.4 |

% |

9.6 |

% |

9.7 |

% |

||||||

Space’s net sales during the fourth quarter of 2021 decreased $317 million, or 10%, compared to the same period in 2020. The decrease was primarily attributable to lower net sales of approximately $385 million due to the June 30, 2021, renationalization of the Atomic Weapons Establishment (AWE) program after which date, the ongoing operations are no longer included in the company’s financial results; and about $80 million for commercial civil space programs due to lower volume (primarily Orion). These decreases were partially offset by higher net sales of about $165 million for strategic and missile defense programs due to higher volume (primarily Next Generation Interceptor (NGI), Fleet Ballistic Missile (FBM) and hypersonic development).

Space’s operating profit during the fourth quarter of 2021 decreased $60 million, or 16%, compared to the same period in 2020. The decrease was primarily attributable to approximately $60 million of lower equity earnings from the company’s investment in United Launch Alliance (ULA) due to launch vehicle mix; and about $25 million for commercial civil space programs due to lower risk retirements and volume (primarily Orion). These decreases were partially offset by an increase of approximately $10 million for strategic and missile defense programs due to higher risk retirements (primarily FBM) that were partially offset by lower risk retirements (primarily hypersonic development). There was not a significant decrease in operating profit for the AWE program as its operating profit in the fourth quarter of 2020 was mostly offset by accelerated and incremental amortization expense for intangible assets as a result of the renationalization. Adjustments not related to volume, including net profit booking rate adjustments, were $10 million higher in the fourth quarter of 2021 compared to the same period in 2020.

Space’s net sales in 2021 decreased $66 million, or 1%, compared to 2020. The decrease was primarily attributable to lower net sales of approximately $535 million due to the renationalization of the AWE program; and about $105 million for commercial civil space programs due to lower volume (primarily Orion). These decreases were partially offset by higher net sales of approximately $405 million for strategic and missile defense programs due to higher volume (primarily hypersonic development and NGI programs); and about $140 million for national security space programs due to higher volume and risk retirements (primarily Next Gen OPIR and SBIRS).

Space’s operating profit in 2021 decreased $15 million, or 1%, compared to 2020. The decrease was primarily attributable to approximately $70 million of lower equity earnings from the company’s investment in ULA due to lower launch volume and launch vehicle mix; and about $20 million due to the renationalization of the AWE program. These decreases were partially offset by an increase of about $35 million for strategic and missile defense programs due to higher volume (primarily hypersonic development programs); and approximately $25 million for national security space programs due to higher risk retirements (primarily SBIRS and classified programs) and higher volume (primarily Next Gen OPIR) that was partially offset by charges of about $80 million on a commercial ground solutions program. Operating profit was comparable for commercial civil space programs as higher risk retirements (primarily space transportation programs) were offset by lower volume (primarily Orion). Adjustments not related to volume, including net profit booking rate adjustments, were $100 million higher in 2021 compared to 2020.

Total equity earnings (primarily ULA) represented approximately $30 million, or 9%, and approximately $65 million, or 6%, of Space’s operating profit during the quarter and year ended Dec. 31, 2021, compared to approximately $90 million, or 24%, and approximately $135 million, or 12%, in the quarter and year ended Dec. 31, 2020.

Income Taxes

The company’s effective income tax rate was 17.7% and 16.4% in the quarter and year ended Dec. 31, 2021, compared to 18.1% and 16.4% in the quarter and year ended Dec. 31, 2020. The rates for the year ended Dec. 31, 2021, and Dec. 31, 2020, benefited from tax deductions for foreign derived intangible income, the research and development tax credit, dividends paid to the company’s defined contribution plans with an employee stock ownership plan feature and tax deductions for employee equity awards. The rate for the quarter ended Dec. 31, 2021 was lower than the rate for the quarter ended Dec. 31, 2020 primarily due to increased research and development tax credits partially offset by a reduction in the tax deduction for foreign derived intangible income.

Use of Non-GAAP Financial Measures

This news release contains the following non-generally accepted accounting principles (non-GAAP) financial measures (as defined by U.S. Securities and Exchange Commission (SEC) Regulation G). While management believes that these non-GAAP financial measures may be useful in evaluating the financial performance of the company, this information should be considered supplemental and is not a substitute for financial information prepared in accordance with GAAP. In addition, the company’s definitions for non-GAAP financial measures may differ from similarly titled measures used by other companies or analysts.

Business segment operating profit

Business segment operating profit represents operating profit from the company’s business segments before unallocated income and expense. This measure is used by the company’s senior management in evaluating the performance of its business segments and is a performance goal in the company’s annual incentive plan. Business segment operating margin is calculated by dividing business segment operating profit by sales. The table below reconciles the non-GAAP measure business segment operating profit with the most directly comparable GAAP financial measure, consolidated operating profit.

|

(in millions) |

2022 |

||||

|

Business segment operating profit (non-GAAP) |

~$7,175 |

||||

|

FAS/CAS operating adjustment2 |

~1,705 |

||||

|

Other, net |

~(350) |

||||

|

Consolidated operating profit (GAAP) |

~$8,530 |

||||

|

1 |

The company’s current 2022 financial outlook reflects known impacts from the COVID-19 pandemic based on the company’s understanding at the time of this news release and its experience to date. However, the company cannot predict how the pandemic will evolve or what impact it will continue to have. Therefore, no additional impacts to the Company’s operations or its supply chain as a result of continued disruption from, or policies in response to, COVID-19 for periods subsequent to the time of this news release have been incorporated into the company’s current 2022 financial outlook. The ultimate impacts of COVID-19 on the company’s financial outlook for 2022 and beyond remain uncertain and there can be no assurance that the company’s underlying assumptions are correct. |

||||

|

2 |

Reflects the amount by which expected total CAS pension cost of $1.8 billion, exceeds the expected FAS pension service cost of $95 million. Excludes $555 million of expected non-service FAS pension income. Refer to the supplemental table “Other Supplemental Information” included in this news release for a detail of the FAS/CAS operating adjustment. |

||||

Net FAS/CAS pension adjustment – adjusted