What the program means for you, and what comes next

Get details about one-time student loan debt relief >

President Biden, Vice President Harris, and the U.S. Department of Education have announced a three-part plan to help working and middle-class federal student loan borrowers transition back to regular payment as pandemic-related support expires. This plan includes loan forgiveness of up to $20,000. Many borrowers and families may be asking themselves “what do I have to do to claim this relief?” This page is a resource to answer those questions and more. There will be more details announced in the coming weeks. To be notified when the process has officially opened, sign up at the Department of Education subscription page. You’ll have until Dec. 31, 2023 to apply.

The Biden Administration’s Student Loan Debt Relief Plan

Part 1. Final extension of the student loan repayment pause

Due to the economic challenges created by the pandemic, the Biden-Harris Administration has extended the student loan repayment pause a number of times. Because of this, no one with a federally held loan has had to pay a single dollar in loan payments since President Biden took office.

To ensure a smooth transition to repayment and prevent unnecessary defaults, the Biden-Harris Administration will extend the pause a final time through December 31, 2022, with payments resuming in January 2023.

Frequently Asked Questions

Do I need to do anything to extend my student loan pause through the end of the year?

-

No. The extended pause will occur automatically.

Part 2. Providing targeted debt relief to low- and middle-income families

To smooth the transition back to repayment and help borrowers at highest risk of delinquencies or default once payments resume, the U.S. Department of Education will provide up to $20,000 in debt relief to Pell Grant recipients with loans held by the Department of Education and up to $10,000 in debt relief to non-Pell Grant recipients. Borrowers are eligible for this relief if their individual income is less than $125,000 or $250,000 for households. Get details about one-time student loan debt relief.

In addition, borrowers who are employed by non-profits, the military, or federal, state, Tribal, or local government may be eligible to have all of their student loans forgiven through the Public Service Loan Forgiveness (PSLF) program. This is because of time-limited changes that waive certain eligibility criteria in the PSLF program. These temporary changes expire on October 31, 2022. For more information on eligibility and requirements, go to PSLF.gov.

Frequently Asked Questions

How do I know if I am eligible for debt relief?

-

To be eligible, your annual income must have fallen below $125,000 (for individuals) or $250,000 (for married couples or heads of households).

-

If you received a Pell Grant in college and meet the income threshold, you will be eligible for up to $20,000 in debt relief.

-

If you did not receive a Pell Grant in college and meet the income threshold, you will be eligible for up to $10,000 in debt relief.

What does the “up to” in “up to $20,000” or “up to $10,000” mean?

-

Your relief is capped at the amount of your outstanding debt.

-

For example: If you are eligible for $20,000 in debt relief, but have a balance of $15,000 remaining, you will only receive $15,000 in relief.

What do I need to do in order to receive debt relief?

-

Nearly 8 million borrowers may be eligible to receive relief without applying—unless they choose to opt out—because relevant income data is already available to the U.S. Department of Education.

-

For borrowers whose income data the U.S. Department of Education doesn’t have, the Administration will launch a simple application in October. Borrowers won’t need to upload any documentation or have an FSA ID to submit their application.

-

If you would like to be notified by the U.S. Department of Education when the application is open, please sign up at the Department of Education subscription page.

-

Most borrowers who apply can expect relief within six weeks.

-

We encourage everyone who is eligible to file the application, but there are 8 million people for whom we have data and who will get the relief without applying unless they choose to opt out.

-

Borrowers are advised to apply by mid-November in order to receive relief before the payment pause expires on December 31, 2022.

-

The Department of Education will continue to process applications as they are received, even after the pause expires on December 31, 2022.

What is the Public Service Loan Forgiveness Program?

-

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your federal student loans after 120 payments working full time for federal, state, Tribal, or local government; the military; or a qualifying non-profit.

-

Temporary changes, ending on Oct. 31, 2022, provide flexibility that makes it easier than ever to receive forgiveness by allowing borrowers to receive credit for past periods of repayment that would otherwise not qualify for PSLF.

-

Enrollments on or after Nov. 1, 2022 will not be eligible for this treatment. We encourage borrowers to sign up today. Visit PSLF.gov to learn more and apply.

Part 3. Make the student loan system more manageable for current and future borrowers

Income-based repayment plans have long existed within the U.S. Department of Education. However, the Biden-Harris Administration is proposing a rule to create a new income-driven repayment plan that will substantially reduce future monthly payments for lower- and middle-income borrowers.

The rule would:

-

Require borrowers to pay no more than 5% of their discretionary income monthly on undergraduate loans. This is down from the 10% available under the most recent income-driven repayment plan.

-

Raise the amount of income that is considered non-discretionary income and therefore is protected from repayment, guaranteeing that no borrower earning under 225% of the federal poverty level—about the annual equivalent of a $15 minimum wage for a single borrower—will have to make a monthly payment.

-

Forgive loan balances after 10 years of payments, instead of 20 years, for borrowers with loan balances of $12,000 or less.

-

Cover the borrower’s unpaid monthly interest, so that unlike other existing income-driven repayment plans, no borrower’s loan balance will grow as long as they make their monthly payments—even when that monthly payment is $0 because their income is low.

The Biden-Harris Administration is working to quickly implement improvements to student loans. Check back to this page for updates on progress. If you’d like to be the first to know, sign up for email updates from the U.S. Department of Education.

Beware of Scams

You might be contacted by a company saying they will help you get loan discharge, forgiveness, cancellation, or debt relief for a fee. You never have to pay for help with your federal student aid. Make sure you work only with ED and our loan servicers, and never reveal your personal information or account password to anyone. Our emails to borrowers come from [email protected], [email protected], and [email protected]. You can report scam attempts to the Federal Trade Commission by calling 1-877-382-4357 or by visiting reportfraud.ftc.gov.

Recent Stories

FREE Shred Day

Join us at Lafayette Federal Credit Union for a Free Community Shred Day, an event dedicated to helping you protect your privacy and the environment! Bring your old bank statements, bills, medical records, and any other paper documents that need secure disposal, and we'll take care of them on the spot.

Why You Should Come:

Protect Your Privacy: Safely shred sensitive documents to help prevent identity theft.

Eco-Friendly: All shredded material will be recycled, supporting our commitment to sustainability.

Complimentary Breakfast: Enjoy a free breakfast on us--start your day right with good food and good company!

Exciting Giveaways & Prizes: Don't miss out on giveaways and be sure to enter our drawing for a chance to win one of four $100 gift cards.

This event is open to all! It's a fantastic opportunity to clean out those old documents cluttering up your home, safe in the knowledge that they will be disposed of securely. Plus, it's completely free!

Don't miss out on this chance to declutter safely, enjoy some free treats, and possibly win a great prize. We look forward to seeing you there, rain or shine!

For more information, contact us at www.lfcu.events/shred.

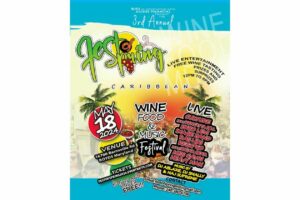

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!