Gaithersburg’s Emergent BioSolutions, located at 300 Professional Drive, announced that it has entered into an agreement to sell its travel health business to Bavarian Nordic (BVNRY) for a total value of up to $380 million, including potential future milestone payments. this announcement was made the same week the company announced that its NARCAN nasal spray was one step closer to FDA approval.

Per the press release: Under the terms of the definitive agreement, Bavarian Nordic will acquire the rights to VIVOTIF®, indicated for the active immunization to prevent typhoid fever, and VAXCHORA®, indicated for the active immunization to prevent cholera, as well as the development-stage chikungunya vaccine candidate CHIKV VLP. Bavarian Nordic will also acquire Emergent’s manufacturing site in Bern, Switzerland, and development facilities in San Diego, California. Approximately 280 current Emergent employees are expected to join Bavarian Nordic as part of the transaction.

“This agreement enables these important vaccines to continue to get to patients and customers who need them while allowing us to further sharpen our focus on protecting and enhancing life through our core products and contract manufacturing services businesses,” said Robert G. Kramer, Emergent president and chief executive officer. “I want to thank our Emergent teammates who will be joining Bavarian Nordic for their dedication to developing and delivering these products that address global health needs.”

The sale of its travel health business builds on Emergent’s previously announced strategic prioritization of its medical countermeasure products, such as ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), TEMBEXA® (brincidofovir), RSDL® (Reactive Skin Decontamination Lotion Kit), several anthrax products, and opioid overdose reversal medicine NARCAN® (naloxone HCl) Nasal Spray, and contract development and manufacturing services businesses. Together, these actions will improve profitability and position Emergent for steady, sustainable growth over the long term.

Emergent will further discuss this transaction during the conference call associated with the announcement of its fourth quarter and full year 2022 financial results scheduled for post-market close on February 27, 2023.

Transaction Details

Upon closing of the transaction, Bavarian Nordicwill pay Emergent $270 million in upfront cash consideration. Additionally, Bavarian Nordic will pay Emergent up to $30 million in sales-based milestones associated with the commercial products and up to $80 million in development-based milestones associated with the CHIKV VLP program. The transaction is expected to close in the second quarter of 2023, subject to regulatory clearance and customary closing conditions.

For Emergent BioSolutions, Wells Fargo Securities, LLC served as financial advisor, and Barnes & Thornburg LLP served as legal counsel for this transaction.

Featured photo courtesy of Google Maps.

Recent Stories

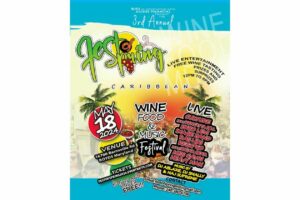

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!