Per Montgomery County (5.9.23): Today the Montgomery County Council enacted Bill 17-23, Taxation – Recordation Tax Rates – Amendments, to increase resources for Montgomery County Public Schools’ construction projects, Montgomery County capital projects and the creation and maintenance of affordable housing through the Housing Initiative Fund. Councilmember Kristin Mink was the lead sponsor of the bill and Councilmember Will Jawando was a cosponsor. The Council’s vote was 7-4 to enact the legislation.

As a result of this legislation, resources to fund capital priorities are projected to increase by $187.3 million over the six-year Capital Improvements Program (CIP) which covers fiscal years 2023 through 2028. Montgomery County’s most recent CIP status report shows a funding gap of $207.5 million, and the additional resources generated through updated recordation rates will help close this gap and fund essential construction projects including schools, affordable housing projects and transportation infrastructure improvements.

“I have heard from residents and parents across the county who share my concern that too many of our school and transportation projects have been delayed for too long. This legislation will help raise nearly $200 million to fund various school projects, including the renovation of Magruder High School, Damascus High School and Highland View Elementary School, among others. The legislation also supports our rental assistance initiatives, recognizing the large number of rent-burdened residents that are in need of help.” said Council President Evan Glass. “At a time when inflationary pressures have increased the cost of construction, we must do what we can to prioritize our schools and infrastructure.”

“I’m extremely grateful to my colleagues for supporting the amended version of this bill and to the advocates in the PTA who worked closely with us to get this done,” said Councilmember Kristin Mink, who serves on the Council’s Education and Culture (EC) and Public Safety (PS) Committees. “This rate adjustment will help us keep our promises to communities badly in need of infrastructure improvements, from schools to transportation to public safety projects, while holding home buyers harmless at and below the median sale price in our County.”

“Today, the Council took steps to ensure that we are able to fund and keep on track needed school construction, fire and police stations, recreation centers, libraries and transportation projects,” said Government Operations and Fiscal Policy (GO) Committee Chair Kate Stewart. “The benefits of this new plan will play a major role in attracting economic development and ensure our infrastructure needs are met across the County.”

“As a cosponsor, I’m very appreciative that the Council has come together to make critical investments to ensure that every student has access to a safe and productive place to learn,” said EC Committee Chair Jawando. “This is a substantial step forward in the pursuit of equitable public school facilities and creates dedicated funding to address the pressing need for rental assistance among our most vulnerable residents.”

The recordation tax is a onetime cost that applies to the principal amount of debt secured by a mortgage or deed of trust when a house or building is purchased. There are three elements of the recordation tax—the base rate, the school increment rate, and the recordation tax premium rate.

Bill 17-23 progressively increases the premium rate payment depending on the value of the recordation, while the base rate ($2.08 for each $500) and the school increment rate ($2.37 per $500) remain the same.

The recordation tax premium will increase from its current rate ($2.30 per $500) as follows: recordations between $600,000 and $750,000 will be charged $5.75 per $500; those more than $750,000 to $1 million will be charged $6.33 per $500; and those valued at more than $1 million will be charged $6.90 per $500.

The recordation tax premium rates are projected to have no effect on the price of affordable housing and will raise $52 million more for rental assistance over fiscal years 2024 through 2028. The new rates will be implemented on Oct. 1, 2023.

The Maryland Department of Legislative Services reports that recordation tax rates across the state range from a high of $7 per $500 transaction in Frederick County to a low of $2.50 per $500 transaction in Baltimore and Howard counties. These costs are generally split between the homebuyer and the seller. Most counties have tax rates set between $3 and $5 per $500. In addition to recordation taxes, many counties have transfer taxes that are paid at settlement ranging from half of one percent to 1.5 percent. The transfer tax rate in Montgomery County is one percent and remains unchanged.

Recent Stories

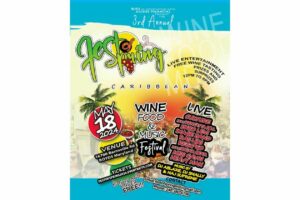

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!