Maryland Comptroller Peter Franchot announced today that the filing and payment deadline for 2021 Maryland state individual income taxes has been extended by three months to July 15, 2022.

The Federal income tax deadline for residents is April 18.

This is third year in a row that the deadline has been extended in an effort to help assist Maryland taxpayers facing financial difficulties due to the pandemic.

Per the Maryland Comptroller’s Office:

Maryland taxpayers have until July 15 to file and pay with no penalty or interest; Federal income tax deadline is April 18

ANNAPOLIS, Md. (January 19, 2022) — Comptroller Peter Franchot announced today the filing and payment deadline for 2021 Maryland state individual income taxes has been extended by three months – to Friday, July 15, 2022 – to assist taxpayers facing financial difficulties due to the COVID-19 pandemic.

The extension announcement came during a virtual news conference with agency officials to discuss the January 24 start date of the 2022 tax season, which is when federal and state individual income tax returns will be accepted. Federal and state corporate income tax returns are already being processed.

Comptroller Franchot’s decision to extend the filing and payment deadlines – essentially a waiver of penalties and interest on outstanding liabilities – from Monday, April 18, 2022 to Friday, July 15, 2022 reflects the pandemic’s continued impact on Maryland individuals and families.

“Many people are still struggling to stay above water, so giving taxpayers more time to file and pay will hopefully ease their financial pressure,” Comptroller Franchot said. “As we approach the two-year mark of the onset of COVID-19, my agency remains as committed as ever to helping Marylanders who still are feeling the pandemic’s impact.”

The Internal Revenue Service, which already has warned of processing delays for the 2022 tax season due to COVID, has not indicated any plans to extend the federal income tax filing and payment deadline beyond April 18.

This is the third consecutive year that Comptroller Franchot has extended filing and payment deadlines to July 15. Those extensions have benefitted roughly 600,000 taxpayers each of the past two years, enabling them to hold on to a combined $1.8 billion as an interest-free loan, which may have allowed them to take care of more pressing issues like paying rent or keeping their businesses open.

Maryland taxpayers do not need to request an extension to receive the three-month grace period; it will be automatically granted to all resident and nonresident filers. Taxpayers who expect to receive a refund should file their return as soon as possible and not wait until July 15 to submit.

Comptroller Franchot reminded taxpayers that changes made last year to both the federal Earned Income Tax Credit (EITC) and the state Earned Income Credit (EIC) may benefit them, particularly Marylanders who file using an Individual Tax Identification Number (ITIN).

“These important credits are a proven tool to help lift low-to-moderate income earners out of poverty,” Comptroller Franchot said. “All taxpayers should check whether they’re eligible for the programs, which can substantially reduce or even eliminate your federal and state tax liabilities.”

With the Omicron variant spreading in communities across the state, Comptroller Franchot has instituted several operational protocols to keep employees and the public safe.

Appointments at any of the agency’s 12 branch offices must be scheduled online in advance. Virtual appointments also are available. No walk-ins will be accepted. Masks are required in all branch offices, regardless of vaccination status.

Taxpayers can call 1-800-MD-TAXES or email [email protected]. The agency’s branch offices and call centers are both open 8:30 a.m. – 4:30 p.m., Monday through Friday. Beginning February 1, the call center will remain open until 7 p.m., only for personal income tax assistance.

For questions related to federal taxes, visit www.irs.gov or call Taxpayer Advocate Service at 443-853-6000 or 877-777-4778 (outside the Baltimore area). You can also get federal tax help at seven Maryland Taxpayer Assistance Centers.

As always, taxpayers are encouraged to file their returns electronically and use direct deposit for the fastest possible processing and to ensure they receive all possible refunds and to avoid continued delays with the United States Postal Service. A list of approved vendors for use in filing your electronic return can be found on the Comptroller’s website.

Maryland taxpayers also can use the agency’s free I-File system.

Last year, the agency processed 3.29 million tax returns, distributed 2.61 million refunds with a dollar value of $3.2 billion. Comptroller employees answered nearly 700,000 phone calls, responded to almost 160,000 emails and assisted roughly 22,000 taxpayers through virtual or in-person appointments.

Recent Stories

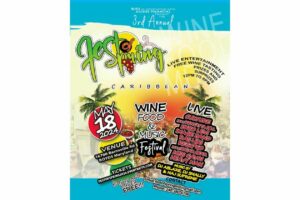

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!