Per MCPD: 4th District officers from the Montgomery County Department of Police have arrested and charged a juvenile male as an adult with theft related charges and illegal possession of a privately manufactured firearm, also known as a “ghost gun.”

On Tuesday, July 25, 2023, at approximately 12:57 p.m., officers responded to the Dick’s Sporting Goods store in the 11100 block of Veirs Mill Road in Wheaton for the report of a shoplifting. When officers arrived at the location, they observed the suspects leaving the store with the stolen merchandise. Officers followed the suspects who ran to the Safeway store in the 11200 block of Georgia Ave. Officers entered the Safeway and observed the suspects in possession of the stolen items from the previous store.

Officers arrested one of the suspects. A search of his person revealed a loaded Polymer 80 9mm handgun with no serial number. Officers also recovered some of the merchandise that was stolen from the Dick’s Sporting Goods store. The juvenile was transported to the Montgomery County Central Processing Unit, where he was charged as an adult with theft and illegal possession of firearm related charges.

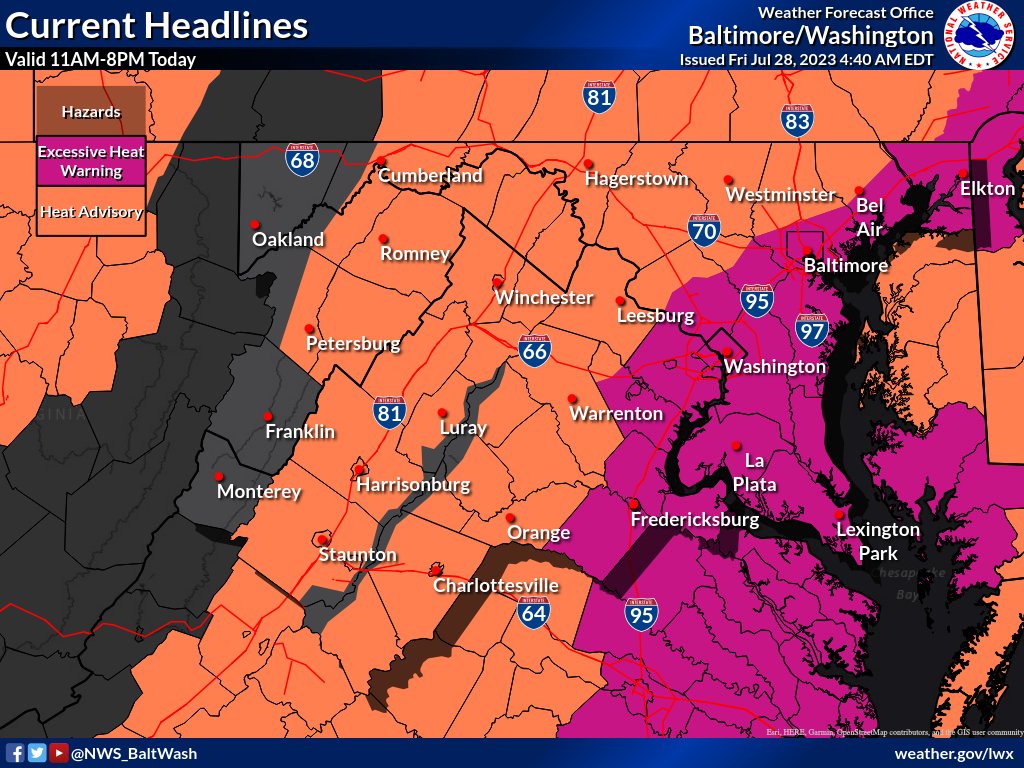

Excessive Heat Warning information for Central & Southeast Montgomery County: https://inws.ncep.noaa.gov/a/a.php?i=87586476

Per Montgomery County Police: The Special Victims Investigations Division is asking for the public’s assistance in locating a missing 15-year-old, Sophia Isabella Roach (age 15).

Sophia was last seen on Tuesday, July 11, 2023 at approximately 9:30 p.m. on the 5600 block of Whitney Mill Way in Rockville. She is 5’2″, brown hair, brown eyes. The clothing she was wearing is unknown. Anyone with information regarding the whereabouts of Sophia Isabella Roach is asked to call Montgomery County Police Non-Emergency (301) 279-8000 (24-hour line).

Mosquitos infected with West Nile Virus were trapped in Maryland– in two parts of Anne Arundel County on July 11, authorities said, and some were also found in the Bowie area of Prince George’s County. So far, no human cases have been reported. “For most people that get West Nile, they have zero symptoms. No symptoms at all,” said Johns Hopkins University senior scholar and physician Dr. Amesh Adalja (per FOX 5).

In response, the Maryland Department of Agriculture (MDA), in cooperation with the Prince George’s County and Anne Arundel County Health Departments, expanded mosquito control services in areas due to a public health concern over the potential for mosquito-borne diseases. While not all mosquitoes carry diseases, MDA suggests that residents take precautions to minimize their exposure to mosquito bites. These measures include:

- Wear long, loose fitting, light colored clothing

- Wear insect repellents according to product labels

- Avoid mosquito infested areas during prime periods of activity (between dusk and dawn)

- Install, inspect, and repair window and door screens in homes and stables

- Regularly clean bird baths and bowls for pet food and water

- Remove or empty all water-holding containers

Per the National Weather Service: “Hot and humid conditions continue today, with heat indices around 110 degrees along the I-95 corridor this afternoon. Excessive Heat Warnings and Heat Advisories are in effect. Isolated to scattered showers and thunderstorms are also possible.”

The heat and humidity continues today (Friday, July 28th) with the heat index likely at/over 105° for the entire county and at/over 110° for some. Afternoon/evening thunderstorms are possible today. Tomorrow will also be very hot and humid with afternoon thunderstorms possible as a “cold front” enters to bring temperatures in the mid to upper 80s on Sunday and into the start of the week.

Also per the National Weather Service: Drink plenty of fluids, stay in an air-conditioned room, stay out of the sun, and check up on relatives and neighbors. Young children and pets should never be left unattended in vehicles under any circumstances. Take extra precautions if you work or spend time outside. When possible reschedule strenuous activities to early morning or evening. Know the signs and symptoms of heat exhaustion and heat stroke. Wear lightweight and loose fitting clothing when possible.

To reduce risk during outdoor work, the Occupational Safety and Health Administration recommends scheduling frequent rest breaks in shaded or air conditioned environments. Anyone overcome by heat should be moved to a cool and shaded location. Heat stroke is an emergency! Call 911

Montgomery County Public Schools released the following community message on Thursday, July 27:

1. Important Information for the Fall Sports Season

We are two weeks away from the start of the high school fall sports season! Here are some key items, as we prepare for the first day of tryouts and practices on August 9, 2023:

High School Fall Sports Registration

Registration for high school fall sports is available through ParentVUE. Tryouts and practices for high schools start on August 9, 2023; details regarding tryout/practice logistics are available through the local school and team(s). Systemwide resources are available on the MCPS Athletics webpage.

Middle School Fall Sports Registration

Registration for middle school fall sports will open through ParentVUE on August 14, 2023, at noon. Tryouts and practices for middle schools start on September 12, 2023. Details regarding tryout/practice logistics are available through the local school and team(s). Systemwide resources are available on the MCPS Athletics webpage.

2. It’s Not Too Late: Unlock the Power of Summer Reading

Summer is the perfect opportunity to foster a love for reading in children beyond entertainment. According to the science of reading, reading is vital to your child’s growth and development. Readers go on journeys through books, expanding their vocabulary, comprehension and critical thinking skills. The brain’s ability to learn in childhood makes this the perfect time to nurture strong reading abilities, empower all children’s academic journeys, and teach empathy and critical thinking skills.

As you plan summer activities, consider incorporating reading into the daily routine. Whether it’s a captivating tale or educational materials, every page turned is a pathway to a bright future for all children.

Resources

-

National Education Association: Get Serious About Summer Reading

-

Imagination Soup: 2023 Summer Reading Lists of Best Books For Kids

3. MCPS is Hiring!

Come out to the MCPS Job Fair on Tuesday, August 8 from 10 a.m.-1 p.m. at Montgomery College’s Rockville Campus Student Services Atrium, located at 51 Mannakee Street in Rockville. We are hiring for professional staff, teachers, administrators, support staff, paraeducators, substitute teachers, food services and more. Check out other upcoming recruiting events:

-

Department of Transportation job fair on Friday, July 28 from 10a.m.-2p.m. at 16651 Crabbs Branch Way in Rockville.

-

Join us for a virtual info session for special education positions from 6-6:30 p.m. on July 31 or August 7.

4. Save the Date: Annual Back-to-School Fair

MCPS is hosting its annual Back-to-School Fair on Saturday, Aug. 26 from 10 a.m. to 1 p.m. at Westfield Wheaton mall. The event is a wonderful opportunity for families to learn about the school system and county programs and services. There will be family-friendly activities, entertainment, an immunization clinic and more. Westfield Wheaton is located at 11160 Veirs Mill Road in Wheaton. Stay tuned to the website for updates throughout the summer.

5. Students Spotlight

Students Receive Extra Support Through ELO SAIL Summer Program

The 2023 session of the MCPS Extended Learning Opportunities Summer Adventures in Learning (ELO SAIL) Program ends this week. This free, 17-day summer program for students in Title I elementary schools helps reduce summer learning loss and prepares students for next school year while providing students fun summer activities. Students have been engaged in hands-on, exciting and enriching literacy, mathematics, and science or STEM instruction, as well as social emotional learning.

Students Participate in smART Camp

The smART summer program is a free visual art summer camp for rising MCPS elementary students in Grades 1-5. The camp is offered in partnership with the MCPS Summer RISE program. Rising high school juniors and seniors are provided an opportunity to work with veteran teachers to explore the field of art education as a viable college to career pathway.

Per Montgomery County: The Montgomery Coalition for Adult English Literacy (MCAEL), in partnership with Montgomery County Executive Marc Elrich and the Montgomery County Council, recently awarded grants totaling $1,425,000 to 21 organizations that provide 27 adult English language learning programs across the County.

MCAEL is a community coalition of public, nonprofit and business partners that support nearly 60 adult English for Speakers of Other Languages (ESOL) and literacy service programs. The goal of the MCAEL grants program is to increase the availability and quality of adult ESOL services, thereby helping adults gain the English language skills needed to reach their potential as parents, workers and community members.

“Montgomery County is one of the most diverse jurisdictions in the nation—home to individuals and families from all over the world representing hundreds of languages and dialects,” said County Executive Elrich. “Learning literacy is critical for creating economic opportunities as well as our County’s workforce development. We have invested more than $1.4 million to help ensure our residents have access to ESOL services. I appreciate MCAEL and the organizations that received these grants for the work they do, which can be lifechanging for thousands of our residents.”

Adult English language learners experience a range of transformative benefits as participants in these programs, from being able to speak to staff at their children’s schools to attaining better-paying jobs.

“MCAEL’s work to promote literacy and break down language barriers improves the lives of program participants and the interconnectedness of our community,” said Council President Evan Glass. “For more than 14 years, MCAEL has provided capacity building grants to providers of adult ESOL classes across Montgomery County. This new round of grant funding provided in partnership with Montgomery County Government will build on this important work and create lasting results for English language learners and our community.”

Larissa, who moved from Cameroon last year, describes not knowing the language as nerve-wracking and lonely. She was afraid to go out.

“I was afraid, and I was ashamed,” said Larissa, who enrolled in English language class at CASA. Soon, she said she “started to have some hope. English was my key.”

Another beneficiary of the program is Karen, who has been taking classes through Family Services, Inc., in Gaithersburg.

“I understand better when someone talks to me,” said Karen. “I feel more confident having a conversation by phone—like doing a medical appointment or requesting information. I have improved my writing. I write emails and notes to my child’s teacher now. English classes helped me to get a job.”

Recipients of these grants include:

- Ana A. Brito Foundation, Inc.

- Briggs Center for Faith and Action

- CASA (Life Skills ESOL Program)

- CASA (Workforce ESOL Program)

- Catholic Charites of the Archdiocese of Washington, Inc.

- Chinese American Parent Association of Montgomery County

- Chinese Culture and Community Service Center

- City of Light Helping Hands

- Classroom 2 Community (formerly Literacy Council of Montgomery County)

- Community Reach of Montgomery County, Inc. (Language Outreach Conversation Classes)

- Community Reach of Montgomery County, Inc. (Language Outreach Program)

- Covenant Life Church

- Ethiopian Community Center

- Family Services, Inc./Sheppard Pratt (ESOL Program)

- Family Services, Inc./Sheppard Pratt (Family Discovery Center)

- Family Services, Inc./Sheppard Pratt (Conversation Classes)

- Francophone Africans Alliance

- The George B. Thomas Leaning Academy, Inc.

- Identity Inc.

- Impact Silver Spring

- Mill Creek Parish United Methodist Church

- Rockville Seniors, Inc.

- Seneca Creek Community Church (Saturday ESOL Classes)

- Seneca Creek Community Church (Weekday ESOL Program)

- Vietnamese American Services (Citizenship Class and Workforce Development)

- Vietnamese American Services (Conversation English Class for Adult Learners)

- Washington New Covenant Fellowship Church

To learn more about this year’s MCAEL adult English language learning grant recipients, visit the MCAEL website.

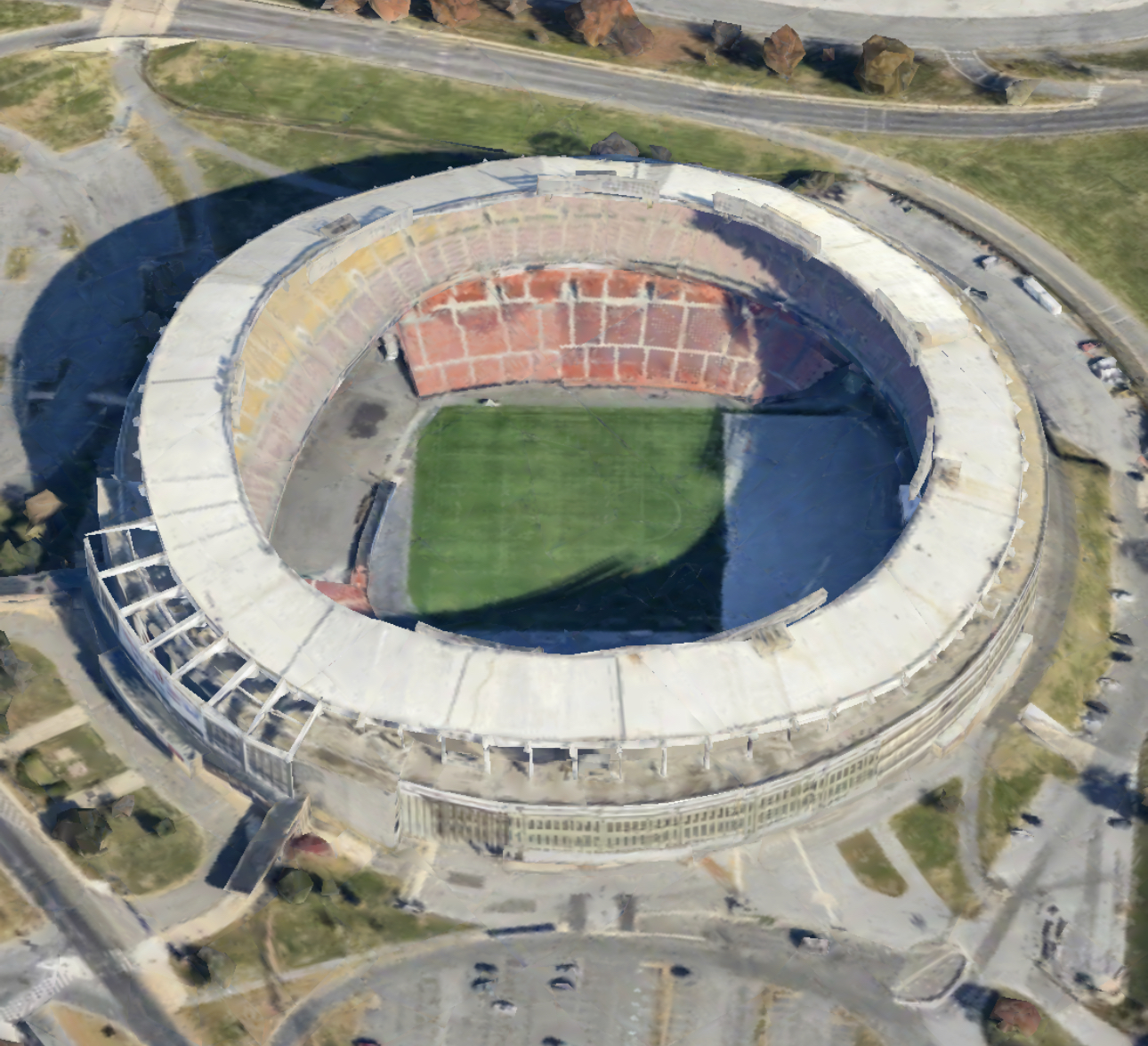

House Committee on Oversight and Accountability Chairman James Comer (R-Ky.) and Congresswoman Eleanor Holmes Norton (D-D.C.) introduced the D.C. Robert F. Kennedy (RFK) Memorial Stadium Campus Revitalization Act, bipartisan legislation that transfers administrative jurisdiction over the RFK stadium site from the Secretary of the Interior to the Administrator of the General Services Administration (GSA). The bill will allow GSA to enter into a lease with the District of Columbia, under which D.C. may use the land for stadium redevelopment, commercial and residential development, or other public purposes.

“The House Oversight Committee remains committed to working with Washington, D.C. officials to ensure a capital that is prosperous for residents and visitors for generations to come. After discussing city initiatives with D.C. Mayor Bowser and other local stakeholders, it has become clear that addressing the deteriorating conditions at the RFK Memorial stadium site is a top economic priority for the city,” said Chairman James Comer. “I’m proud to introduce the bipartisan D.C. Robert F. Kennedy Memorial Stadium Campus Revitalization Act, which is long overdue legislation that will provide D.C. leaders the opportunity to revitalize the RFK stadium site. This legislation is set to pave the way for local officials to create meaningful new jobs, add millions in city revenue, and transform the Anacostia River waterfront into a lively destination for all.”

“The RFK site sits on underused federal land in D.C. that could be redeveloped, generating tax revenue for D.C.,” Norton said. “Neither the Mayor nor the Council Chair opposes this bill, which would allow D.C. to put the site to productive use – a vast improvement on the current state of affairs. I look forward to working with Chairman Comer to pass this bill as quickly as possible.”

Background: The RFK Memorial Stadium opened in 1961 and hosted its last event in 2017. The D.C. Robert F. Kennedy Memorial Stadium Campus Revitalization Act transfers administrative jurisdiction over the RFK stadium site from the Secretary of Interior to the GSA, which has a track record of managing commercial leases. Under the Act, GSA would be required to enter into a lease with the District of Columbia, under which D.C. may use the land for stadium purposes, commercial and residential development, providing recreational facilities or open space, or additional public purposes. The bill allows for a lease of up to 99 years which may be renewed by GSA.

The legislation also requires development to not adversely impact any lands under National Park Service jurisdiction, designate at least 30 percent of the land as open space, improve access to the Anacostia River and Anacostia River Trail, provide parking for residential and commercial development, provide adequate safety and security measures, and reduce the impact of noise on surrounding areas.

Read bill text here. Featured photo courtesy of Google Earth.

Maryland tax free week will take place from Sunday, August 13th until Saturday, August 19th this year. Below we have everything you need to know about how Tax-Free Week works in Maryland:

Facts About Tax-Free Week: From 12:01 a.m. on the second Sunday in August through midnight on the following Saturday, qualifying clothing and footwear priced $100 or less will be exempt from Maryland’s six percent sales tax. The first $40 of back/bookbag sales also qualify. A list of exempt and taxable items is available on the Comptroller’s Website at www.marylandtaxes.gov, or by calling the Taxpayer Service Section at 410-260-7980 in Central Maryland or toll-free 1-800-MD TAXES from elsewhere.

Definitions for the Shop Maryland Tax-Free Week: “Clothing or footwear” means an article of apparel designed to be worn on or about the human body. “Accessory items” include but are not limited to jewelry, watches, watchbands, handbags, handkerchiefs, umbrellas, scarves, ties, headbands, and belt buckles.

Exempt Sales: The sales and use tax is not due on the sale of a qualifying article of clothing or footwear if:

• The sales price of the article is $100 or less; and

• The sale takes place during a period beginning he second Sunday in August and ending at 12 midnight on the following Saturday.

The exemption applies to each qualifying item selling for $100 or less, regardless of how many items are sold at the same time. For example, if a customer purchases two shirts for $80 each, both items qualify for the exemption, even though the customer’s total purchase price ($160) exceeds $100.

Taxable Sales: The exemption does not apply to:

• Accessory items, even if they are priced at $100 or less;

• The first $100 of a more expensive single article or set (as in a suit) of clothing or footwear. For example, if a customer buys a pair of pants costing $110, sales tax is due on the entire $110;

• Any special clothing or footwear primarily designed for protective use or not intended for everyday use.

Example: football pads are primarily designed for protective use and are not normally worn except when used for that purpose and therefore do not qualify for the exemption;

• Taxable services performed on clothing or footwear, such as alterations.

Example: sales tax is due on alterations to clothing, even though the alterations may be sold, invoiced, and paid for at the same time as the clothing being altered;

• If a customer purchases a pair of pants for $90 and pays $15 to have the pants cuffed, the $90 charge for the pants is exempt, but tax is due on the $15 alterations charge; and

• Purchases of items used to make or repair clothing or footwear, including fabric, thread, yarn, buttons, snaps, hooks, and zippers.

Specific Situations and Examples:

Articles Normally Sold as a Unit: Articles normally sold as a unit must be sold that way during the sales tax holiday. They cannot be priced separately and sold as individual items to qualify for the exemption. However, components normally priced as “separates” may still be sold as separate articles and any piece that is $100 or les will qualify for the exemption.

Example: if a pair of shoes sells for $150, the pair cannot be split and each shoe sold for $75 to qualify for the exemption. If a suit is normally priced at $225 on a single price tag, the suit cannot be split into separate articles so that any of the components may be sold for $100 or less to qualify for the exemption.

Sales of Sets Containing Both Exempt and Taxable Items

When exempt clothing or footwear is sold together with taxable merchandise as a set or single unit, the full price is subject to sales tax unless the price of the exempt clothing or footwear is separately stated.

Example: if a boxed gift consisting of a shirt (otherwise exempt) and tie (taxable) is sold for a single price of $80, the full price of the boxed gift set is taxable because the tie is taxable and the sale price of the shirt is not separately stated.

When exempt clothing is sold in a set that also contains taxable merchandise as a free gift and no additional charge is made for the gift, the exempt clothing qualifies for the exemption.

Example: A boxed set contains a shirt and a free handkerchief. If the set sells for $50 and the price of the same shirt sold separately is $50, the item being sold is the shirt, and the boxed set is exempt from the tax.

Discounts and Coupons

Discounts: If a retailer offers discounts to reduce the price of an eligible item to $100 or less, the item will qualify for the exemption.

Example: A customer buys a $150 dress and a $110 blouse from a retailer offering a 10 percent discount. After applying the 10 percent discount, the final sales price of the dress is $135, and the blouse is $99. The dress is taxable because the price is more than $100, and the blouse is exempt because the price is less than $100.

Coupons: When retailers accept coupons as a part of the selling price of a taxable item, the value of the coupon is excludable from the tax as a cash discount, unless a third party reimburses the retailer for the amount of the coupon (a manufacturer’s coupon).

Example: A customer buys a pair of shoes priced at $110 with a retailer’s coupon worth $10 off. The final sales price of the shoes is $100. Since the retailer issued the coupon and is not reimbursed by a third party, the shoes qualify for the exemption.

Example: If a customer purchases a pair of shoes priced at $110 with a manufacturer’s coupon worth $10 off, the consideration paid for the pair of shoes is $100, but the shoes do not qualify for the exemption as a third party coupon was redeemed.

Absorption of the Sales Tax: A vendor may assume or absorb all or any part of the sales and use tax on a retail sale and pay that tax on behalf of the buyer. The vendor must, however, continue to separately state the tax from the sales price at the time of the sale to the purchaser. If the vendor absorbs all or any part of the tax on the sale, the vendor shall pay the tax with the return that covers the period in which the vendor makes the sale.

Buy One Get One Free or for a Reduced Price: The total price of items advertised as “buy one get one free” or “buy one get one for a reduced price” cannot be averaged to qualify both items for the exemption. The application of the exemption depends on the actual price paid for the item.

Example: A retailer advertises pants as “buy one get one free.” The first pair of pants is priced at $120 and the second pair is free. The tax is due on the $120. Having advertised that the second pair is free, the store cannot ring up each pair of pants for $60 to qualify both for the exemption. However, if the retailer advertises and sells the pants for 50 percent off, selling each pair of $120 pants for $60, each pair of pants qualifies for the exemption.

Example: A retailer advertises shoes as “buy one at the regular price, get a second pair for half price.” The first pair of shoes is sold for $120 and the second pair is sold for $60. Tax is due on the $120 pair of shoes, but not on the $60 pair. Having advertised that the second pair is half price, the store cannot ring up each pair of shoes for $90 so the items qualify for the exemption. However, if the retailer advertises the shoes for 25 percent off, thereby selling each pair of $120 shoes for $90, each pair qualifies for the exemption.

Rebates: Rebates occur after the sale and do not affect the sales price of an item for purposes for the sales tax holiday period exemption.

Example: A customer buys a sweater for $110 and sends for and later receives a $12 rebate from the manufacturer. The retailer should collect tax on the $110 price of the sweater.

Layaway Sales: A layaway sale is a transaction in which merchandise is set aside for future delivery to a customer who makes a deposit, agrees to pay the balance of the purchase price over a period of time, and, at the end of the payment period, receives the merchandise. Under Maryland law, the sale is made when the layaway agreement is entered into, and so qualifying items placed on layaway during the sales tax holiday period are exempt.

Example: A customer puts ten items of qualifying children’s clothing, each costing $100 or less, on layaway during the sales tax holiday period. The customer completes the layaway and receives the merchandise after the sales tax holiday period. The total purchase is exempt from the tax.

Rain Checks: Eligible items purchased during the sales tax holiday period using a rain check qualify for the exemption regardless of when the rain check was issued. However, if a rain check for an exempt item is issued during the sales tax free period, the purchase is exempt only if the rain check is redeemed during the Sales Tax Holiday period. If it is redeemed later, the purchase is not exempt.

Exchanges: If a customer buys an eligible item during the exemption period and later exchanges it for the same item (different size, different color, etc.) tax is not due even if the exchange is made after the sales tax holiday period.

Example: A customer buys a $35 shirt during the exemption period. After that period, the customer exchanges the shirt for the same shirt in a different size. Tax is not due on the $35 price of the shirt received in the exchange.

If a customer buys an eligible item during the exemption period and returns the item after that period for credit on the purchase of a different item, the sales tax applies to the sale of the newly purchased item even if it would have eligible for the exemption during the sales tax holiday period.

Example: A customer purchases a $35 shirt during the exemption period. After the exemption period, the customer exchanges the shirt for a $35 jacket. Because the jacket was not purchased during the exemption period, tax is due on the $35 price of the jacket.

If a customer buys an eligible item before the exemption period and returns it during that period for credit on the purchase of a different eligible item, sales tax is not due on the sale of the new item if it is purchased during the sales tax holiday period. However, the credit cannot be used to reduce the price of an item costing more than $100 to make it eligible for the exemption.

Example: During the sales tax holiday period, a customer buys a $60 dress. Later, during that period, the customer exchanges the $60 dress for a $95 dress. Tax is not due on the $95 dress because it was also purchased during the sales tax holiday period and otherwise qualifies for the exemption.

Example: During the exemption period, a customer buys a $90 dress that qualifies for the exemption. Later during the exemption period, the customer exchanges the $90 dress for a $150 dress. Tax is due on the $150 dress. The $90 credit from the returned item cannot be used to reduce the sales price of the $150 item to $60 for exemption purposes.

Returned Merchandise: For a 30-day period after the sales tax holiday period, when a customer returns an item purchased during the period that would have qualified for the exemption, retailers may not refund or credit the

sales tax unless the customer provides a receipt or invoice showing tax was paid or unless the retailer can document that tax was paid on the specific item. This 30-day period is set solely to designate a time period during which the customer must provide documentation showing that sales tax was paid on returned merchandise. The 30-day period is not intended to change retailers’ policies concerning the time period during which they will accept returns.

Online Internet Orders, Mail, Telephone, E-mail, and Custom Orders: A sale of tangible personal property occurs when title or possession of the property is transferred in exchange for consideration. Therefore, an eligible item may qualify for this exemption if:

• The item is both paid for by the customer and delivered to the customer during the exemption period or;

• The customer orders and pays for the item and the retailer accepts the order during the exemption period for immediate shipment, even if delivery is made after the exemption period.

An order is for immediate shipment when the customer does not request delayed shipment, even if other factors, such as a backlog of orders or unavailable stock, cause the delay.

Shipping and Handling Charges

Separately stated shipping or delivery charges are not included in determining the sale price of otherwise eligible items.

Example: A customer orders a jacket for $95 during the exemption period. An additional shipping charge of $6 is separately stated on the bill. The shipping charge is not included in the price subject to the tax and the price of the jacket is, therefore, $95 and qualifies for the exemption.

However, a combined shipping and handling charge is legally considered as part of the sales price of an item, even if the combined charge is separately stated from the price of the item. These charges must be added to the price of eligible clothing or footwear to determine if the price of the item is $100 or less.

Example: A customer orders a jacket for $95 during the exemption period. A shipping and handling charge of $6 is added to the bill. The sales price of the jacket is $101 and tax is due on the full sales price.

If more than one item is shipped on a single invoice, the separately stated combined shipping and handling charge must be proportionately allocated to each item ordered and separately identified on the invoice, based on the price of each item.

Example: A customer orders a suit for $285 and a shirt for $95. The shipping and handling charge is $15. The $15 charge must be proportionately and separately allocated between the items: $285/$380 = 75 percent; therefore, 75 percent of the $15 shipping and handling charge, or $11.25, must be allocated to the suit, and separately identified on the invoice. The remaining 25 percent of the $15 shipping and handling charge, or $3.75, must be allocated to the shirt, and separately identified on the invoice. The sales price of the shirt is $95 plus $3.75, totaling $98.75; therefore, the shirt qualifies for the exemption.

Refunds: Retailers are encouraged to refund the tax to any customer who was charged the sales tax on an exempt item. Customers who were charged the tax by a retailer for exempt purchases should take their tax paid receipt to the retailer for refund. If the retailer has not already remitted the tax to the Comptroller, the retailer should simply refund the tax to the customer. If the retailer has remitted the tax to the Comptroller, the retailer should refund the tax to the customer and then take a credit for the tax refunded on the retailer’s sale and use tax return.

Documenting Exempt Sales: Retailers’ records must clearly identify the type of item sold, the date it was sold, and the sales price. The Comptroller will not require any special reporting procedures to report exempt sales made during the sales tax holiday period. Sales should be reported as currently required by law.

Courtesy of Marylandtaxes.gov

Torrey Moore, the man accused of murdering his 8-month pregnant girlfriend, Denise Middleton, and a gas station clerk, Ayalew Wondimu, in White Oak last December was found competent to stand trial, according to a report by MyMCMedia. Moore was previously ruled not competent to stand trial. The trial for the murder of Wondimu begins April 8, 2024. Trial begins May 8 for the murder of Middleton and her unborn baby boy. The chilling details of what occurred last year can be seen below in the Statement of Charges, per the Montgomery County State’s Attorney:

“On 12/8/22 at 3:00 PM, Montgomery County Police responded to a convenience store at the Shell Gas station located at 11150 New Hampshire Ave, Silver Spring, Montgomery County, Maryland for a report of a shooting. Upon arrival, officers found the victim, Ayalew Wondimu, a black male with date of birth of 11/6/61, suffering from multiple gunshot wounds. Investigation revealed the victim was working inside the store, behind the register when he was shot. Wondimu was pronounced deceased on the scene.

Your affiant (Detective Dimitry Ruvin) reviewed surveillance video from inside and outside the store. The video showed the suspect entering the store at 2:58PM. The suspect selected a soft drink and then approached the victim, who was standing behind the cash register. The suspect appeared to have a conversation with the victim and then picked up several items from on top of the counter and threw them at the victim. The victim picked up a pole and attempted to strike the suspect. The suspect then backed up and produced a handgun and fired at the victim.

The victim fell down behind the register. The suspect then approached the counter, leaned over and fired several more shots into the victim’s body. The suspect then picked up the soft drink and left the store. Torrey Damien Moore, a black male with date of birth of 4/13/91, was developed as a suspect and your affiant obtained an arrest warrant charging the suspect with First Degree Murder (CR 2-201) and Use of a Firearm in a Felony / Violent Crime (CR 4-204 (b)).

Your affiant also obtained a search warrant for the suspect’s residence located at 11235 Oak Leaf Drive, Apartment 809, Silver Spring, Montgomery County, Maryland. The search warrant was served on 12/9/22. The suspect was arrested inside the residence. A Jimenez Arms semiautomatic handgun was recovered from the residence during the execution of the search warrant. A body of a deceased female was discovered on the floor of the bedroom of the apartment residence. The body was in an advanced stage of decomposition.

The suspect was transported to the Montgomery County Police headquarters, advised of his Miranda rights and interviewed. The suspect confessed to going to the store in question, engaging in an altercation with the store clerk and shooting him. The suspect was asked about the deceased female in his apartment and he stated that it was his girlfriend, Denise Middleton, a black female with date of birth of 3/14/96.

While talking to the suspect, your affiant discussed a possibility that Denise Middleton was shot with the same gun as victim, Ayalew Wondimu, at the gas station store. The suspect responded, “I’m pretty positive she was shot with the same gun”

The suspect stated that he briefly left the residence and when he returned he discovered the victim deceased and found a gun in his residence. He later used this gun to shoot the store’s clerk. The suspect denied killing the victim, Denise Middleton. Your affiant asked the suspect to go over the circumstances surrounding Denise Middleton’s death and he described the following:

Sometime in October of 2022, the suspect responded to New York City to bring Denise Middleton back to Maryland. When asked to narrow the timeframe, the suspect stated he left for New York right after he contacted the Montgomery County Police about a vandalism to his apartment door. Montgomery County police records showed that he filed that report on 10/5/22. The suspect stated the two returned back to Montgomery County from New York city shortly thereafter. On the day of Denise Middleton’s death, they left the apartment to get food. According to the suspect he began arguing with Denise Middleton on the way back to the apartment. The suspect stated, “I pushed her down” in front of his apartment residence. The suspect stated Denise Middleton was “acing like I was trying to kill her”. The suspect stated he told Denise Middleton to “get off the ground” and “stop putting on a show”. The suspect stated once at the residence, Denise Middleton was “still kirking out a little bit.” The suspect stated, “a slap was probably thrown” and “I probably choked her a little bit. The suspect stated he and Denise Middleton then went into the bedroom and that he was trying to calm Denise Middleton down. The suspect stated he then left to buy some marijuana. The suspect stated he returned within an hour and discovered Denise Middleton deceased. When asked if Denise Middleton had any gun shot wounds or other wounds the suspect stated that he was not sure. The suspect further stated that Denise Middleton was pregnant and that she told him that the baby was his. The suspect stated that the baby was due in October and that it was a boy. The suspect continued to deny killing Denise Middleton. The suspect also stated a few days after discovering Denise Middleton deceased, he travelled to California and stayed there for over a month. He recently returned back to Maryland and to his residence.

Your affiant wants to note the following about the ballistic evidence in this case. Four (4) FC 9mm luger spent shell casings were recovered at the Shell gas station store scene. The handgun recovered in the suspect’s residence contained one (1) live FC 9mm luger round in the chamber and six (6) rounds in the handgun’s magazine. Two (2) spent FC 9mm luger shell casings were found near Denise Middleton’s body.

On 12/10/22, your affiant attended the autopsy conducted at the Office of the Chief Medical Examiner (OCME) for the State of Maryland. Your affiant learned Denise Middleton was shot seven (7) times and several projectiles were recovered from her body. A male fetus was discovered during the autopsy. Your affiant was advised by a forensic pathologist that the fetus was viable.

The suspect’s criminal history includes arrests for Armed Robbery, First and Second Degree Assaults, Robbery with Deadly Weapon, Kidnapping, CDS Possession with Intent to Distribute, Loaded handgun on person and other charges. Your affiant also learned the suspect was currently wanted for an aggravated assault on victim Denise Middleton from Norfolk, Virginia. Your affiant obtained a police report dated 6/2/22 from Norfolk Police. In that case, Denise Middleton told police that the suspect “had punched and then choked her for about three minutes to the point she could not breath”.

Based on the above stated facts, your affiant has probable cause to believe that the suspect, Torrey Moore, murdered the victim, Denise Middleton. Your affiant further believes in doing so, the suspect caused the death of a viable fetus. Based on the above stated facts, your affiant requests an arrest warrant be issued for Torrey Damien Moore charging him with First Degree Murder (CR 2-201) (Victim – Denise Middleton) and Murder or Manslaughter of Viable Fetus (CR 2-103).

The above stated events occurred in Silver Spring, Montgomery County, Maryland.”

After reviewing the report by the Office of Court-Ordered Evaluations and Placements (OCEP) within the Department of Health (MDH), Judge Amy Bills ruled last week that Moore is not competent to stand trial and is scheduled a date for a competency hearing on June 13th, 2023. She also scheduled a preliminary hearing for January 6th, 2023.