Per the press release: Ruth’s Chris was founded in 1965 in New Orleans, Louisiana, by Ruth Fertel and features signature USDA Prime steaks served sizzling on 500-degree plates, New Orleans-inspired sides and an award-winning wine list. Ruth’s Chris has 154 locations around the globe, including 80 company-owned or -operated restaurants and 74 franchised restaurants, generating systemwide sales of over $860 million, total revenues over $500 million, and average annual restaurant volumes for company-owned or -operated locations of $6.2 million in Ruth’s fiscal year 2022.

“Ruth’s Chris is a strong and distinctive brand in the fine dining segment with an impressive history of delivering elevated dining experiences to their loyal guests,” said Darden President and CEO Rick Cardenas. “It fits the criteria we have for adding a brand to our portfolio and supports our winning strategy. Ruth’s Chris is a great complement to our portfolio of brands, and I’m pleased to welcome their nearly 5,000 team members to Darden.”

Cheryl Henry, President, CEO and Chairperson of Ruth’s, stated, “We are excited about the opportunity to join the Darden family. Our strategy and operating philosophy aligns well with Darden, and we have a strong cultural fit that should ensure a smooth transition. This transaction will also provide more opportunities for our team members to develop in their careers as we continue to grow our 57-year-old iconic brand.”

Highlights

- Darden has agreed to acquire Ruth’s for $21.50 per share, with a total transaction equity value of approximately $715 million, representing a 34% premium to the May 2 closing price and a 32% premium to the 30-day volume weighted average price.

- Purchase price represents a 9.4x implied multiple of Ruth’s fiscal year 2022 Transaction Adjusted EBITDA.*

- Darden expects pre-tax synergies of between $5 and $10 million within the first year, and between $15 and $20 million in the second year.

- Total acquisition and integration-related expenses are expected to be approximately $55 to $60 million.

- Expected to be accretive to Darden’s diluted net earnings per share in fiscal year 2024 by approximately 10 to 12 cents, excluding acquisition and integration-related expenses.

- Transaction is expected to be completed in June, subject to satisfaction of customary closing conditions.

- The transaction has been unanimously approved by the boards of directors of both Darden and Ruth’s.

- Cheryl Henry will continue to lead as President of Ruth’s Chris and will report to Rick Cardenas.

Recent Stories

Mayor Jud Ashman and members of the City Council hosted the 2024 State of the City address on Thursday, April 18, at Asbury Methodist Village.

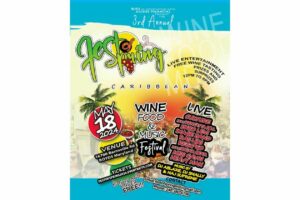

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!